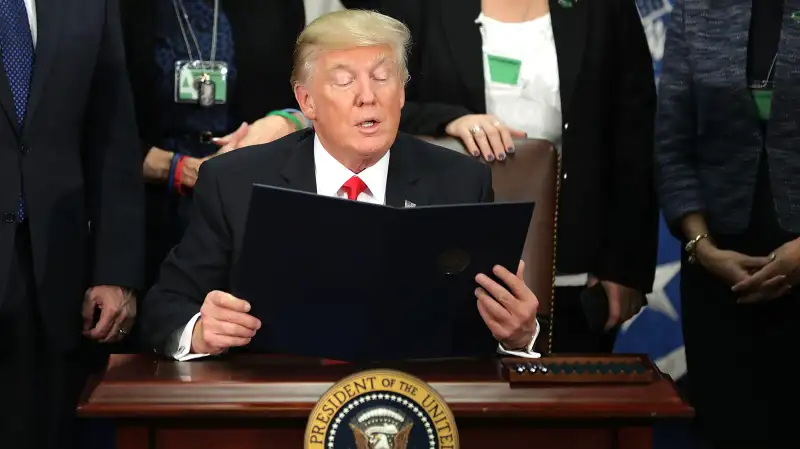

Several Big Hedge Funds Have Written Letters Warning Their Clients About Donald Trump

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Business leaders initially hailed Donald Trump's election as a victory for looser financial regulations and lower taxes that would improve investment opportunities.

And since Nov. 8, the Dow Jones industrial average has shot up more than 1,500 points — briefly piercing the 20,000 level for the first time in history.

But now, the so-called smart money — institutional investors and the high-net-worth set — is starting to question whether Trump's protectionist agenda, which Wall Street was willing to overlook early on in the Trump rally, could outweigh the benefits of some of the President's business-friendly positions on deregulation.

In a recent letter to clients, hedge fund managers at Carlson Capital, which oversees $9.9 billion in assets, warned of a "global depression and a major equity market decline" if Trump implements a proposed tariff plan, Bloomberg reported.

"It is still unclear whether it will happen but at the very least we expect that U.S. trade policy will put downward pressure on global growth,” they write.

The Carlson team is referring to Trump's proposed "border adjustment tax," which would levy new fines on businesses importing goods from abroad instead of manufacturing them at home.

In a recent note to his Bridgewater Associate clients, Ray Dalio, the 56th-richest man in the world with a net worth of $16 billion according to Forbes, said that Trump's recent pronouncements had created "exceptional uncertainty" in markets.

Given these risks, he now recommends against making "concentrated bets," according to Bloomberg.

“While there is a lot of potential to improve fiscal policies and make beneficial structural reforms (to enhance the business friendly environment, reduce regulatory inefficiencies, etc.), there is also significant risk that his populist policies could hurt the world economy (and worse),” Dalio said in the note obtained by Bloomberg.

David Einhorn of Greenlight Capital, which has more than $9 billion in assets under management, hit on a similar theme in a Jan. 17 letter to clients.

"Our sense is that Mr. Trump doesn't hold any core policy beliefs and is apt to change his mind as he sees fit," he said. "This will lead to more political and economic uncertainty and less stability."

Such misgivings may help explain why, after an initial post-election surge, the broad stock market has slowed its ascent since December. In fact, industrial stocks — which would be among the most effected by any trade war started by "border adjustment taxes" — have been flat since Dec. 7.

As a hedge, investors have been plowing into gold, which was up 5% for January, its best month since June. Gold is one of Einhorn's top five largest positions according to CNBC.

Jeff Gundlach, who has been among the most successful bond investors in recent years and whose DoubleLine Capital fund manages $101 billion in assets, is also bullish on gold.

However, he has maintained a more nuanced view of the investing landscape. He said Trump's trade policies will likely result in a weaker dollar, which will push up inflation.

As a result, U.S. exports will become more attractive for foreign buyers — but that will not be good news for U.S. equities.

"It makes sense to start incrementally allocating out of the U.S. and into the non-U.S.," he said according to CNBC.