Trump's Latest Tweet About Taxes Is a Lie, According to Every Tax Expert

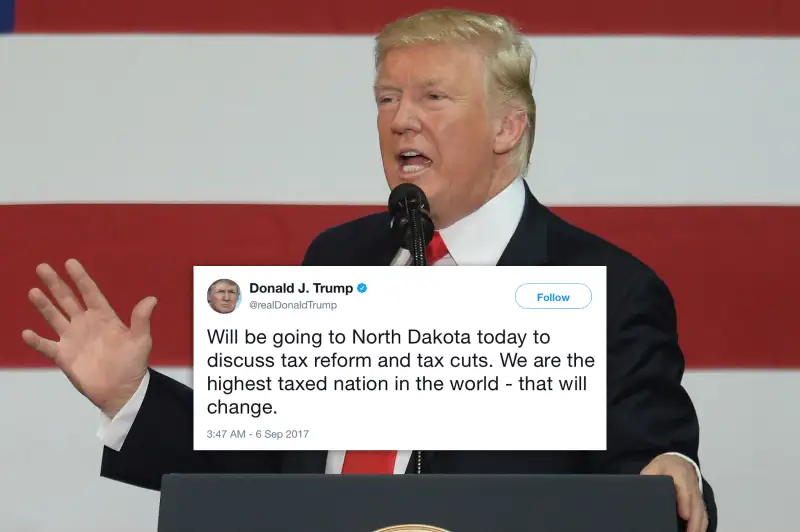

As Trump geared up to sell his tax plan on Wednesday, he took to Twitter repeating one of his favorite talking points: That the U.S. has the highest taxes in world. The only problem? While Trump has made that point frequently—repeating it last month and the month before—it's simply not true.

At this point Trump's lying about the U.S. tax burden has become something of a running joke—the kind of joke that makes you want to pull your hair out—among experts who pay attention to the tax code. Here is one fellow at the right-wing American Enterprise Institute responding to Trump's tweet:

Here is The Wall Street Journal's tax reporter responding:

If that's not enough, two-well regarded Washington think tanks, the Tax Policy Center and the Tax Foundation, also contradict the claim. So why does Trump keep repeating something that both his would-be ideological allies and neutral observers call a lie?

Probably because it suits his political purposes and it sounds like something else many voters have heard which is true.

While the U.S. is not the highest taxed nation in the world, one part of the tax code—the part that applies to corporations—does impose the highest nominal rate among developed nations: 38.9% counting both federal and average state rates.

Economists on both sides of the aisle don't like that aspect of the tax code, which they think restrains growth and encourages tax avoidance. Even looking at just corporate taxes, however, having the highest nominal rate doesn't make the U.S. the "highest taxed."

That's because the corporate tax code is riddled with loopholes and deductions, meaning relatively few companies pay this top rate. Estimates differ for what corporations actually pay, but a popular answer is 27% to 28%—which ranks middling to high but not highest among other nations.

Trump's claim is wrong in another big way, however.

Corporate taxes represent only a fraction of total U.S taxes. The U.S. and other nations levy a variety of personal income, property, sales and other taxes. Economists have attempted to compare the U.S. tax system to other nations', factoring these in too. The result: Among 35 developed nations the U.S. ranks fourth from the bottom, according to a recent study by the OECD.

The upshot: While Trump's frequently repeated talking point about the U.S. being "the highest taxed nation in the world" sounds like a different fact you may have heard before which is true, Trump's assertion is not only not true, but close to the opposite of what is true.