The Biggest Stock Splits of 2022 and What They Mean for Investors

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Monday marked the first trading day after Google parent Alphabet implemented its 20-for-1 stock split.

The price of a single share of the company stock became more affordable after the split, dropping from roughly $2,200 on Friday to $113 on Monday morning.

Retail investors — and sometimes professionals — are often enamored of stock splits, which lower a company’s price per share by multiplying the number of shares available. But experts say a key thing for investors to remember is that the activity in and of itself doesn't change a company's fundamentals.

A stock split doesn't change the trajectory of that company's performance, and there's no telling if share prices will rise after a split. (At the market closing on Monday, Alphabet stock was priced under $110 — a drop of over $2.5% on the day.)

A stock split “doesn't in and of itself make the company more valuable,” says Keith Buchanan, senior portfolio manager at Globalt Investments in Atlanta. “If it’s a stock an investor feels like is an attractive value, it should be an attractive value before and after the split.”

The argument in favor of stock splits historically has been that slashing the cost of a high-flying stock would make it more attainable for investors who couldn’t afford the pre-split price of a share. But with the proliferation of online and mobile trading platforms that allow fractional shares — buying just a “slice” of a stock — investors have been able to buy positions in any stocks they want.

Nonetheless, investors tend to view stock splits as a positive sign, and companies often get a bump in their valuations when announcing and implementing the maneuver.

Stock splits in 2022

Google’s 20-to-1 stock split — meaning that anyone holding one share of Google before the split will have 20 today — is one of the biggest in recent history on the benchmark S&P 500 index, Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, told Money.

So far, the three most high-profile stock splits this year have all been in the technology sector. This makes it a little tough to parse the impact of the splits on each company’s share price, since the broad tech sector has been under intense pressure this calendar year, as investors fret about rising interest rates and high earnings expectations in the face of what many consider an increasingly likely economic downturn.

Below are the year's biggest stock splits that have occurred or are anticipated, and what investors need to know in a troubling period for stocks in general.

Amazon

The e-commerce giant announced a 20-for-1 stock split back in March. Amazon stock quickly climbed by about 5% on the news and continued trending higher for the next couple of weeks, but has foundered since then. Trading began at the new price as of June 6.

This year’s was the first stock split Amazon had undertaken since 1999, when it executed a 2-to-1 split that brought each share price to $57.50. Prior to its most recent split, a share of Amazon stock was worth $2,785.58, which converted to $139.28 after the 20-to-1 split. It closed last week at $113.55.

Shopify

Shopify completed a 10-for-1 stock split on June 28 and began trading at the new ratio on June 29, but neither the announcement nor the new share price was able to stop the Canadian online shopping platform’s slide.

Shopify stock has dropped by roughly 76% in 2022, and the company has reportedly slashed its internship program and laid off workers.

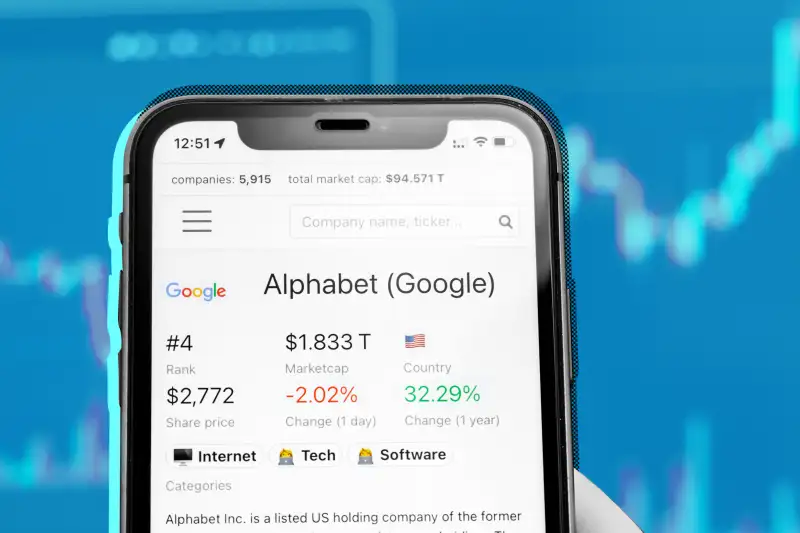

Alphabet

Alphabet stock registered a slightly bumpy start when it started trading at its split-adjusted price of about $113 on Monday, July 18, falling by more than 2%. Some analysts held out expectations that it will recover to increase in value, the way Apple and Tesla both did after their most recent stock splits in 2020.

Ali Mogharabi, senior equity analyst at Morningstar, characterized Alphabet as a good buy in a previous Money interview, on account of growth in its search advertising, cloud service and YouTube business lines.

GameStop

The OG of meme stocks, GameStop is set to implement a 4-for-1 stock split this week, with trading beginning at the new split price on July 22.

Although its current pre-split value of roughly $150 is less than half of the all-time high of $347.51 it hit in January of 2021, it still represents an astronomical rise for the beleaguered retailer, given that GameStop traded for less than $3 as recently as April of 2020.

Tesla

Last month, Tesla announced in a regulatory filing that it plans to seek shareholder approval for a 3-for-1 stock split when it holds its annual meeting in August. The electric carmaker first broached the prospect of a stock split back in March. This piqued the interest of both Wall Street and retail investors, but Tesla offered no details at the time.

Although not a tech stock, Tesla has faced pressure this year as investors ponder the implications of a slowing economy, and as famously mercurial CEO Elon Musk has engaged in a sometimes-contentious, on-again, off-again bid to buy Twitter and take the social media company private. Tesla stock started the year at $1,199.78 and has tumbled nearly 38% since then.

Should you buy into a stock split?

As last year’s Reddit-fueled meme-stock craze illustrated, sometimes a surge of investor sentiment can trigger inexplicable momentum. For instance, retail investors are credited with giving GameStop a new lease on life. Without that push, its executives wouldn’t be in a position to explore a stock split.

“There was a notion that stock splits always ended with the price going higher,” Buchanan says. “It was kind of a self-fulfilling prophecy. It's a fascinating thought process of who makes markets.”

But from an investment point of view, following the herd isn’t a foolproof strategy.

“The latest bull market has obviously ended and we’re in a tougher financial position as far as expectations for the economy,” Buchanan says. “The bear market reveals how illogical some notions of investing have become.”