You Can Soon Use Venmo to Make Purchases on Amazon

Got a balance burning a hole in your Venmo app? Soon, you can put it to use on Amazon.

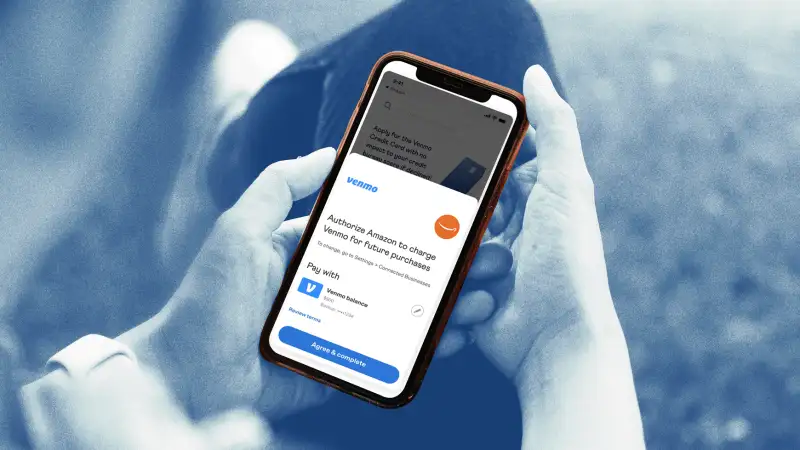

Amazon announced Tuesday that it's working on allowing customers to add their Venmo accounts as a payment method. The integration, which is already being rolled out to some accounts, will allow users to make Amazon purchases with their Venmo balance. Customers can also use Venmo to pay with their debit cards or linked bank accounts.

In a news release, Amazon said it's aiming to make the Venmo payment option available to all U.S. customers within the next month — aka in time for holiday shopping.

“We want to offer customers payment options that are convenient, easy to use and secure,” Max Bardon, vice president of Amazon Worldwide Payments, said in the release. “Whether it’s paying with cash, buying now and paying later or now paying via Venmo, our goal is to meet the needs and preferences of every Amazon customer.”

Venmo transactions on Amazon will be protected by Amazon’s customer service guarantee, which ensures customers can get refunds when buying from third-party sellers, as well as Venmo’s purchase protection, which can give relief to buyers who encounter certain transaction issues.

Partnering with Amazon is a significant development for Venmo, which was once basically known as the app we used to pay our friends back for dinner. Owned by fintech giant PayPal, Venmo is now used for everything from food delivery (think: Grubhub) to sports betting (DraftKings). You can also pay with Venmo using a QR code in certain stores, including Urban Outfitters and CVS.

Venmo is well on its way to becoming a widely accepted payment method for online and IRL purchases alike, as well as a leading service for peer-to-peer transactions. In 2021, Venmo even introduced the option to buy crypto.

The company also has its own debit cards, which allow you to use your Venmo balance wherever you shop, and credit cards issued by Synchrony.

More from Money:

6 Best Credit Cards of October 2022