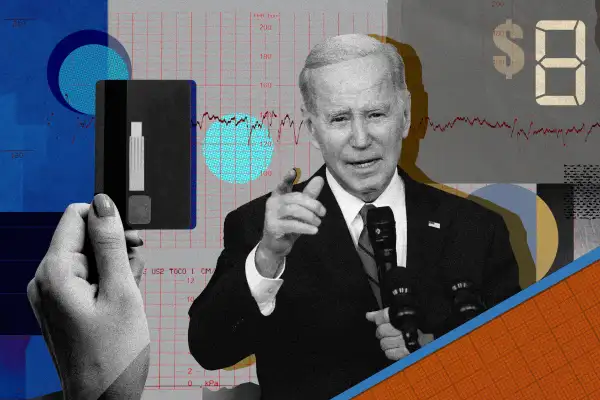

Biden's New Plan to Slash Credit Card Late Fees Could Save Americans $9 Billion per Year

President Joe Biden wants to rein in what his administration sees as excessive late fees charged by credit card companies. Biden is announcing a new rule on Wednesday that would lower credit card fees to $8 for a late payment, down from the current $41 limit.

Why it matters

Americans are charged about $12 billion each year in credit card late fees, according to the Consumer Financial Protection Bureau (CFPB), a federal watchdog agency. The fees vary by issuer, but typically are the equivalent of the minimum monthly payment amount for the first missed payment — up to a max of $30 — and up to $41 for subsequent missed payments. The CFPB is the government body in charge of proposing the new rule, which would not require Congressional approval.

- The CFPB estimates the rule would reduce late fees charged to credit card holders by upwards of $9 billion per year.

- The agency is collecting public comment on the proposal, and the details may change based on the comments it receives.

- The rule could go into effect as early as 2024.

CFPB Director Rohit Chopra outlined the new rule to reporters on a call Tuesday, ahead of Biden’s announcement.

“By our estimates, 75% of late fees — $9 billion — have no purpose beyond padding the credit card companies’ profits,” Chopra said on the press call.

Key context

The CFPB says this new rule is an effort to close a loophole in the 2009 Credit Card Accountability Responsibility and Disclosure (CARD) Act, which was passed by Congress to, in part, enhance disclosures and limit fees for consumers.

- However, after its passage, the Federal Reserve added an “immunity provision” on certain fees like the late payment fee, allowing credit card companies to charge what the CFPB now sees as unreasonably high late fees.

- The current cap to these specific late fees that are immune from the CARD Act rise annually based on inflation. The CFPB also wants to end that provision.

"We found that, over time, this loophole has morphed into a multi-billion dollar bonanza," Chopra said.

The new proposal is the latest effort from the Biden administration to curb what it calls “junk fees.”

Other junk fees in the Biden administration’s sights include fees for overdrafts, non-sufficient funds and bounced checks as well as other fees levied by phone service providers, hotels and airlines.

More from Money:

6 Best Credit Cards of February 2023

9 Best Cash Back Credit Cards of February 2023

Why Customers Say American Express Is Their Favorite Credit Card Company