I Took All My Money Out of the Stock Market and It Feels Amazing

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Do I think the stock market is about to crash? Am I afraid that with Donald Trump at the helm of our ship of state the economy is at risk of going down like the Titanic?

Sure, that could happen. But that’s not why I took my dough off the table.

Back in the early 1980s, I inherited $50,000. At the time, that was so much more money than I’d ever had before that I decided I’d better educate myself about financial matters.

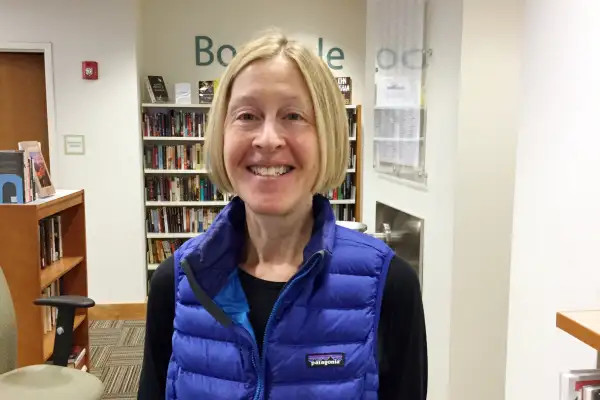

After much research, I put that money — and a percentage of the money I’ve made since as a writer and part-time librarian — into a low-cost index fund. Specifically, I invested in a Vanguard balanced fund that invests 60% of its assets in the stock market and 40% in bonds.

And I left it there.

This turned out to be a good strategy. Back then, the S&P 500 index of U.S. stocks was at 208. Now it’s closing in on 2,600.

Nevertheless, I cashed it all in last week.

Now all my money is stashed in U.S. Treasuries, Treasury Inflation-Protected Securities (or TIPS bonds), and laddered CDs, which, in the years to come, I can count on to earn me essentially nada.

Why would I do this?

I once figured out exactly how much money I would need to live on — not lavishly, but comfortably — for the rest of my life. I promised myself that once I had that amount, I would actually do just that — take my money out of the market and live on it for the rest of my life.

Last week, I reached that goal.

I’m 62. I’ve spent decades caring about the market. I counted on it to make me enough money so that I’d be able to cash in my chips and walk away when I hit retirement age.

And so it did.

And now? It’s time for this librarian to declare victory and get the hell out.

The day after I cashed out, the market soared, as if to say, “Ha ha Roz, the joke's on you.”

Did I feel some regret?

Of course I did! Had I waited just a day, my bank account would be fatter than it is now. But that’s not the point. The point is no longer amassing as much money as I can. It’s peace of mind.

And that’s what I’ve got.

Timing is everything. But you can’t time the market. I have no idea whether it’s about to go up or down. But I no longer care.

I now have enough money to live on for the rest of my life with absolutely no concern about what the market is up to. The Dow Jones industrial average could zip up to 30,000 (and I hope for the sake of those of you who are still in the game that it does.) Or it could crash and burn tomorrow.

Not my problem. That part of my life is over. I’ll never again experience the elation of a market that is rocketing into the stratosphere. Or that sick feeling you get as the market is “correcting” and your net worth is circling the drain.

All done.

But if the market totally tanks tomorrow, you ask, and stocks become such a crazy bargain that I’d be a fool not to put at least some of my money back into that mutual fund that served me so well, wouldn’t I?

Of course I would! I’m no fool. Plus, the one thing I’ve learned about the market over the past three decades is “what goes down, eventually comes back up.” But until that happens, I’m staying put. And if it never happens? I’m still set.

So how much money have I got? I’m not exactly a millionaire. But I do have a nest egg in the high six figures, a modest home with no mortgage, and zero debt. That might not impress you, but it’s good enough for me.

Now that I’ve made my nut, I have no big plans to buy a yacht or travel around the world or even splurge on a few extra outfits from Eileen Fisher.

I plan to continue to work at my local public library and write essays. Which is to say that I’ll continue to do the work I love, which provides me with a small but steady income. (And, at age 70, I’ll start collecting Social Security, which, both because I’m an optimist because I believe in the lobbying power of the AARP, I fully expect to be, like me, alive and well.)

I'm not saying you should follow my lead. You could be more of a risk taker than I am. (Most people are.) Or more worried about inflation. (I'm betting on the TIPS to shelter me from that.) You might have more expenses, or more people who rely on you financially. Your own goal could be to leave a bucket of money to your heirs. (I'm leaving that task to my wealthy ex-husband, although I do expect to leave the kids at least enough to put my grandchildren through college.)

Whatever your financial goal is, I hope you reach it.

The stock market has been very good to me. Without money in the market, there’s no way that this part-time library worker and freelance writer would now have enough money to live on into her 90s.

But, as the song goes, you’ve got to know when to hold them and know when to fold them.

And for me, the time to fold them has come.

I’m out of here. Best wishes. Enjoy the ride.

(Roz Warren is the author of Our Bodies, Our Shelves: A Collection of Library Humor.)