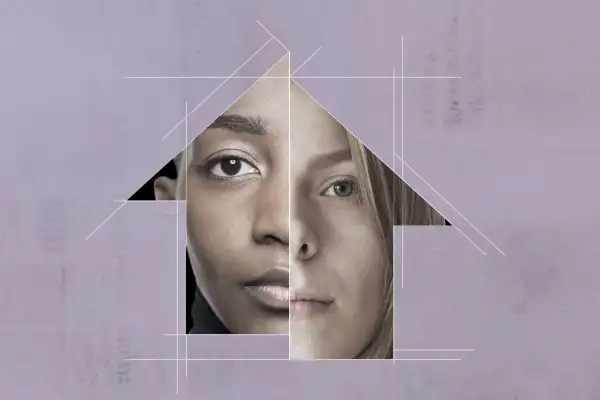

Black Homeownership Is Lower Than It Was a Decade Ago. What's Going On?

Record low interest rates made the dream of buying a home and settling down a reality for many Americans during the last two years. For many others, the dream stayed just as far away as before.

Homeownership saw the fastest year-over-year growth ever in 2020. Nearly 2.6 million households were able to buy a home that year, bringing the total homeownership rate to 65.5% — the highest rate since 2010, according to a new analysis by the National Association of Realtors. But while 2020 was a boon for many, there is a significant racial divide when it comes to access to homeownership. Black households in particular face significant barriers.

In 2020 — the most recent year for which reliable data is available — Black households saw the smallest increase in homeownership rate compared to households of other races — increasing by just 1.4 percentage points to 43.4%. By contrast, white ownership increased by 2.3 percentage points to 72.1%.

“The gap between the Black homeownership rate and the white homeownership rate has been incredibly persistent,” says Jessica Lautz, vice president of demographics and behavioral insights at NAR.

Looking at the change in ownership rates during the period between the Great Recession and the start of the pandemic, the difference is stark. While the homeownership rate for white households increased (70.6% versus 72.1%) the Black homeownership rate actually decreased from 44.2% to 43.4%.

Why is the gap so big?

As Lautz points out, “there’s no one answer” as to why the gap has grown. But one reason is a lack of affordability.

Just 51% of homes currently listed for sale are affordable for households earning at least $100,000. According to a different NAR survey, the median household income for Black homebuyers is just $82,300 and only 20% of black households has an income higher than $100,000. The makes most of the housing stock currently on the market unaffordable for 80% of the demographic.

White homebuyers, on the other hand, had a median household income of $101,900.

Black households also tend to have a tougher time saving up enough cash for a down payment, according to NAR data. Black households tend to spend a higher share of their monthly income on rent and have a higher rate of student loan debt compared to white households. Lautz notes that many Black homebuyers (33% according to NAR) are single women, who earn less than their male counterparts.

“If you have a higher amount of student loan debt and you’re paying a disproportionate amount of your income towards rent,” says Lautz. “It’s going to be very hard to save for a down payment.”

Meanwhile, 7% of Black applicants were denied a mortgage compared to 4% of White applicants. The most common reason for not being approved was high debt-to-income ratios and low credit scores.

Besides economic barriers, Black households also report a higher degree of discrimination in the homebuying process. Of those who were successful in buying a home last year, 7% of black buyers reported some form of discrimination throughout the homebuying process compared to 1% for white buyers.

Just as there’s no simple answer to why the racial gap hasn’t narrowed, there’s no simple solution, according to Lautz. Becoming aware of the gap and addressing the issues that cause it are the first steps towards making progress. Financial literacy programs and first-time homebuyer programs are just some of the tools that can help achieve racial equality in the housing market.

More from Money:

'We Could Be Living in the 1890s': How Housing Discrimination Is Still Perpetuated Today

The Faces of Personal Finance Are Changing, and These Trailblazers Are Forging a More Inclusive Path

Oregon Is About to Ban a Popular Homebuyer Bidding War Tactic