Your 401(k) Is Just One Piece of the Retirement Puzzle. Here's the Right Place for It

There’s no shortage of advice about how to invest your 401(k). But if you have not just a 401(k) but also other savings vehicles — like a IRA, brokerage account, investment property or even a pension — those rules might not apply.

“For those who are fortunate enough to have assets outside of their qualified retirement plan, it is wise to zoom out and view your 401(k) in the context of your overall portfolio,” says Debra Neiman, principal of Neiman & Associates Financial Services.

Particularly in a volatile economic climate like the one investors face today, a big-picture strategy with a focus on diversification can help you maximize your investment earnings and even save on taxes, according to financial planning and wealth management professionals.

Don’t think of your 401(k) asset allocation in a vacuum.

“Ideally, you want your 401(k) investments to complement your taxable holdings. For example, if you own growth-oriented securities in your taxable account, it may make sense to diversify your portfolio by adding dividend and other income-producing securities in your 401(k),” Neiman says.

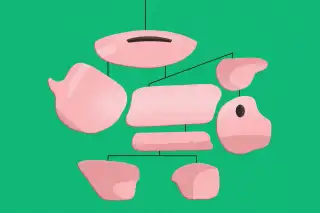

In other words, you might think of your 401(k) as the star player, but it’s still part of a team.

Know when it pays to be bolder.

If you have a guaranteed source of income such as a pension or annuities, treat those holdings as if they were bonds, says David Littell, professor of taxation at The American College of Financial Services.

When you combine those with your 401(k), your overall allocation might be more risk-averse than you expected. This means you might want to consider a more aggressive asset mix in your 401(k) than would be suitable for someone who only has a 401(k). “You might say you should keep it all in stocks because your total allocation is still pretty conservative,” Littell says.

Don’t assume new job = 401(k) rollover.

Just because you might have moved on from a job doesn’t necessarily mean you should ditch your old employer’s 401(k) plan. If, for instance, you used to work at a big company and transferred to a smaller firm, you might want to leave your previous 401(k) in the old employer’s plan for as long as you can rather than rolling it over into an IRA.

While rollovers are often recommended for people looking to consolidate their nest egg, if you already have a varied portfolio, it might be worth keeping that account parked where it is.

“Sometimes, larger plans offer access to lower cost institutional shares that individuals might not have access to due to investment minimums,” Neiman says. (Also, not all but some IRA investment options can come with higher fees, so if you’re considering an IRA rollover, make sure to check that out.)

When you have traditional and Roth accounts

If you have a traditional 401(k) funded with pre-tax dollars as well as a Roth IRA, the fact that you contribute post-tax dollars to the latter is an important distinction, says Dana Levit, owner of Paragon Financial Advisors. “Since you’re never going to pay taxes on those again, that’s where you might want to carry the riskier holdings,” she says.

Here's the logic behind that recommendation: Investing in stocks or funds of small-cap, overseas or developing-market companies, which tend to be volatile, is risky, but the flip side of taking on that risk is the potential for higher returns. Making those riskier bets via a tax-preferred account funded with after-tax dollars means that you get to keep all of those earnings because Uncle Sam already got his slice of the pie. Provided you take a qualified distribution from the account, you won’t be charged income or capital gains tax.

In this scenario, you’d want your 401(k) to house your slow-and-steady earners — think fixed-income products like bonds and bond funds, stocks and funds of large-cap companies and so on, Levit says.

Younger investors, here’s how to maximize your time horizon.

If you’re under 40 and have the option of switching your 401(k) to a Roth 401(k) — a once-obscure option a growing number of employers today offer — you should seriously consider it, says Chad Parks, founder and CEO of Ubiquity Retirement + Savings. “I would put all my growth into a Roth,” he says. “Think of it as a pyramid of risk,” with your 401(k) at the top of the pyramid and your other investment accounts holding less risky assets.

If you have a portfolio with multiple holdings — in other words, if you’re not relying wholly on a 401(k) and Social Security — it’s possible that your post-retirement income stream will put you in a higher tax bracket than you might have anticipated, Parks says. “Paying a smaller amount of tax today is better,” he advises.