5 Books to Help College Students Avoid Going Broke, According to Personal Finance Experts

This is the time of year when parents are packing their cars to ferry college kids to their new dormitory homes. Along with those XL twin bedsheets and shower caddies, there’s another necessity you should be tucking into their boxes of stuff: A good book on managing money in college.

College is the time when kids generally get their first taste of financial freedom: They may be buying their own food, paying for their own entertainment, and getting their first credit card. Some will be working a job in addition to being a student, and they could be trying to save up for a big purchase like a car.

Figuring out how to budget in college is essential for students who don't want to wind up even further in debt after graduation. What's more, starting college students on solid financial footing now means that they’ll get four years of practice before they launch into the “real world” of adulthood.

Money asked experts in money management and financial literacy — including some who specialize in the dormitory demographic — for their top recommendations of books that will appeal to young adults (i.e. won’t just collect dust on a shelf) and offer solid principles and strategies for becoming financially independent and smart about managing money. Here's what they say are the best money books to give college students.

Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry

Matt Schulz, chief industry analyst at CompareCards.com, says author Erin Lowry has a knack for presenting personal finance in an accessible way in her blog and book of the same title, Broke Millennial.

“She has a talent for making complex, confusing topics relatable and interesting,” Schulz says. “So many of the personal finance books you find online or at the library are drier than the Sahara and a challenge to get through. This is not one of those books.”

In other words, there's a good chance Broke Millennial will appeal to a student even if she's already up to her eyeballs in textbook reading assignments.

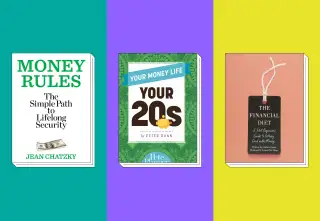

Money Rules: The Simple Path to Lifelong Security by Jean Chatzky

“This is a simple money manifesto with basic yet crucial approaches to spending, saving, investing, increasing income and building wealth,” Gigi Hyland, executive director of the National Credit Union Foundation, says of Jean Chatzky's Money Rules.

Hyland says college kids will appreciate the book’s “simple and entertaining” way of presenting money concepts on which young adults can base their personal financial management through their college years and beyond.

Your Money Life: Your 20s by Peter Dunn

Phil Schuman, director of financial literacy at Indiana University’s MoneySmarts program, says Your Money Life is good for college students who need an introduction to money management as well as those who already have the basics down.

“The information is presented extremely well and focuses on improving the financial habits of the reader and not just improving their literacy,” Schuman says. "Any reader of the book with come away with a good view of how they can successfully set up their financial path."

The Financial Diet: A Total Beginner’s Guide To Getting Good With Money by Chelsea Fagan

CompareCards’ Schulz calls The Financial Diet by Chelsea Fagan “a perfect choice for someone who’s just trying to get their feet under them when it comes to money.”

Schulz says the book is extra user-friendly thanks to its relatable voice and easy-to-understand lessons. “It totally doesn’t read like a personal finance book,” he says. “It’s witty, it’s clever and it has lots of style, and those things make a difference when you’re trying to deliver messages about something like personal finance.”

Spend Well, Live Rich: How to Get What You Want with the Money You Have by Michelle Singletary

"This is one of the most practical, straightforward books about personal finance that I know,” Bruce McClary, spokesman at the National Foundation for Credit Counseling, says of personal finance columnist Michelle Singletary's Spend Well, Live Well.

Singletary presents information in a tone that teens and young adults will appreciate. “It’s honest and relatable in a way that empowers readers to make healthy financial choices without feeling like they are being scolded,” McClary says.

We’ve included affiliate links into this article. Click here to learn what those are.