4 Reasons Why Bill Gross Leaving Pimco Is Such Big News

It many not be LeBron leaving Miami, but on Wall Street, at least, it was arguably an even bigger deal. Bill Gross, long one of the biggest stars in money management, has resigned from the Newport Beach, Calif., asset management giant Pimco and will be heading to Janus Capital in Denver.

Why Gross is such big news

Gross's $221 billion Pimco Total Return fund (PTTCX) is one of the largest mutual funds on the market—in fact, it has more assets than any bond fund in the world. And it's a mainstay in many 401(k) plans. So there is a good chance at least some of your retirement savings are at stake. Because it invests largely in a diversified mix of government and corporate bonds, for many people Pimco Total Return is the primary holding for money they don't put in the stock market.

And since Gross's fund and Pimco, the firm he founded in 1971, are major players in the market for U.S. Treasuries, he also has been an important public figure, with financial journalists closely following his comments on interest rates, Federal Reserve policy, the U.S. debt and other economic issues. Similar to famous stock investors like Warren Buffett, news that Gross was buying something could move markets.

But Gross has been in the spotlight for less flattering reasons lately. We don't know all the details; the first news of his departure came from a press releases issued by Janus this morning. Both the Wall Street Journal and CNBC are reporting that Pimco was ready to push him, if he hadn't jumped.

Maybe it shouldn't have been a surprise

Gross has a famously quirky personality that helped to build Pimco's brand. He writes colorful shareholder letters and started practicing yoga before it was cool among money managers. According to one report, Gross didn't like people to look him in the eye on the trading floor. None of this mattered when Pimco was delivering outsize investment returns. But lately performance has lagged -- in the past year Pimco Total Return finished in the bottom tenth of its Morningstar category -- in part because of missed calls on the direction the Treasury market. And that may have made his quirks harder for some to take.

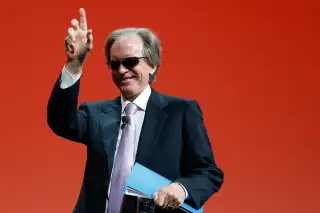

After the high profile departure of Gross' protege and presumed successor Mohamed El-Erian earlier this year, Bloomberg Businessweek put Gross on the cover with the headline “Am I Really Such a Jerk?” Gross didn't tone it down. In June, he gave what many regarded as an odd speech at a large investment conference, wearing sunglasses and comparing himself to Justin Beiber.

To top it all off, the Wall Street Journal broke news earlier this week that Pimco was being investigated by the SEC. It's too early to tell where, if anywhere, that could lead. (More here.)

For Pimco, and its investors, it's a time to wait and see.

While Bill Gross has always been the public face of Pimco, the Newport Beach, Calif., money manager which oversees a total of $2 trillion, is a lot more than Gross.

Businessweek ran a story in May 2013 called "Pimco Prepares for Life After Bill Gross," noting Gross was 69 at the time. Pimco is known for its deep bench. According to it's Web site it has more than 700 investment professionals. Another Pimco star, Chief Economist Paul McCulley, who had retired from Pimco in 2010, returned in May.

The big question is whether the investment magic will remain with Pimco or go with Gross. There is one recent precedent worth looking at. In 2009, another high-profile, equally flamboyant bond manager, Jeffrey Gundlach, left his long-time employer, TCW, in acrimonious circumstances and founded a new firm known as DoubleLine. The DoubleLine Total Return (DBLTX) fund has proved a success, beating the market over the past three years and attracting more than $30 billion. But controversy has followed Gundlach too. He made headlines earlier this year after getting embroiled with fund researcher Morningstar.

This may give Janus new life.

If you're old enough to remember the first Internet bubble -- the one that popped in the early 2000s -- there's a good chance you know Janus. For a time, the Denver fund company, which bet and won big on the era's tech names, seemed like middle America' gateway to Internet riches. At the peak of the bubble, according the New York Times, half the money flowing into mutual funds went to Janus. That all changed later in the decade when investors departed in droves. Janus has been trying to recapture its former glory ever since.

Since 2002 the company has had five different chief executives. The latest one -- a Pimco alum named Dick Weil who arrived in 2010 -- has been trying to broaden the company's focus beyond stock funds. That's where Gross appears to fit in. According to the Janus release, he'll be running an "unconstrained bond fund." Those investments, called unconstrained because they can invest in a wider array of securities than traditional bond funds, have proved popular at a time when ultra-low interest rates have hurt traditional fixed income returns. But as you might guess, there are risks too. Janus is probably betting that Gross's popularity will reassure investors otherwise reluctant to take another chance with it.