Everything You Need to Know About Money on One Index Card

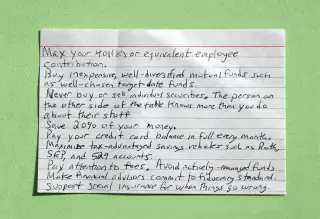

One of the all-time best pieces of personal finance advice got its start purely by chance. Back in 2013, Harold Pollack, a University of Chicago public policy professor, was conducting an online video interview with Helaine Olen, author of Pound Foolish, a book about the financial advice industry. To make the point that Wall Street advice is overly complicated, Pollack grabbed an index card and jotted down nine basic financial rules that he and his wife had been living by. It was all you needed to know.

Pollack posted the card on his blog, and it quickly went viral, garnering hundreds of thousands of hits. Noted academics and pundits tweeted it out. Media outlets, including the Washington Post and Money, wrote stories about it.

Now that single card has morphed into a 240-page book, “The Index Card,” co-written by Pollack and Olen. Even though it’s a bit thicker than an index card, it's still easy to read and full of helpful tips. In a recent interview, Pollack explains why the card turned into a book and how to put his personal finance rules into action.

Q. So it turns out that people need to know more than the nine rules on a card?

A. Even the 10 commandments needed some back-up material. The nine rules are still the essential things you need to know about personal finance. But most people require a bit more practical information to fully understand the rules and put them into practice. It’s one thing to say max out your 401(k), but you may not fully understand how your plan works. Or to raise the deductible on your insurance—you might wonder, what is a deductible? The book provides just enough explanation to follow the rules.

Q. You made a couple of tweaks to the original rules. One of them is to recommend saving 10% to 20% of your income rather than a flat 20%. Why the change?

A. I do think 20% is a good goal to aim for, and it’s appropriate for people like tenured professors at the University of Chicago who have income to save. But for a mass audience, putting in a range of 10% to 20% is more helpful—that’s something [my co-author] Helaine felt strongly about, and it makes sense. For someone like a low-income single mom trying to pay the bills, telling them to save 20% isn’t practical. It may be obvious, but the best way to make your saving happen is to automate it and gradually increase the amount. The idea is to have a sustainable savings plan that’s reasonable for you, and to be more conscious about your spending, so your money is going to what you need and really value—not on things you don’t care about.

Q. You also added rules about buying a home and insurance.

A. Those were topics I had left out of the original card, and we felt it was important to include them. People spend a lot of money on those items, and a lot can go wrong, as a look back at the housing bubble will tell you. With home buying, the message is to make sure you’re financially ready, which means having an emergency fund plus enough for a 20% down payment. When you do, shop around for a plain-vanilla, fixed-rate 15- or 30-year mortgage. Think of your home as something you will use, not a ticket to investing riches. Your home is the most leveraged and undiversified investment you will ever make—and if you're overambitious and something doesn't go right, it may cause you the most financial harm.

Q. One of the rules is make sure your financial adviser is a fiduciary. The Department of Labor has a regulation in the works that would require retirement plan advisers to meet this standard. But the financial services industry is lobbying against it.

A. Most people don’t understand what being a fiduciary means, or that their adviser may not be one. A fiduciary is required to put your interests first. For example, they can’t just sell you high-cost funds that pay them the biggest commission—that wouldn’t be in your interest. But most financial advisers follow a lesser standard, called the suitability standard, that doesn’t require them to give you the best deal. Say an index fund is appropriate for you. Identical index funds may charge different fees—one may cost 0.10%, while the other charges 0.60%. An adviser following a suitability standard could put you in the higher cost fund and not even tell you about the cheaper option. And many advisers do just that. I’m hopeful that the fiduciary standard will be enacted. But the best way to make sure your adviser is a fiduciary is to have them put it in writing. And to minimize conflict of interest, look for one that is fee-only, so they’re paid by you and only by you. I think good financial advice is valuable, but the most valuable service is not the investment products. It's the insight the adviser can provide and the help with financial planning. That's worth paying for, so don't expect it to be free.

Q. You kept in place the last rule, even though it got some criticism, which is to support the social safety net.

A. Some people felt that it was political, not financial. But it’s something that I felt was really important, and it would have been dishonest not to include it. No matter how much we plan and save, we all run the risk of being hit by a catastrophe—illness, disability, job loss. We have to protect to each other against those life risks that would crush any one of us if we had to bear it alone. Even when things are going well, most of us depend on government programs—whether entitlements like Medicare or Social Security, or subsidies and tax breaks that work like a social safety net, such as federal student loans or deductions for employer-provided health insurance. In my own life, I have a brother-in-law with disabilities, and even though I have a good job and income, I could never have managed his care on my own. So my family has been helped by safety net programs. It’s in all our interests to make sure these programs are strengthened and continue.