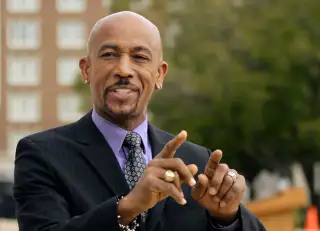

Montel Williams Got Called Out On Twitter For Endorsing Payday Loans—And He Didn't Handle It Well

You may have heard of Montel Williams, actor, producer, and host of the long-running but now-defunct Montel Williams Show. You may also know that Williams is a spokesperson for Money Mutual, a lead generator for so-called payday lenders.

On Thursday, that side-business got a little awkward for the former host when an education activist named André-Tascha Lammé called out Williams on Twitter for "Support[ing] the *most* predatory of loans in existence, PayDay loans. Designed to prey on the poor."

Williams denied the charge, which prompted the following exchange:

Montel is either being disingenuous—deliberately not addressing Lammé's point—or he just doesn't understand the real-world effect of payday lending. The truth is that a large portion of payday customers end up in dire financial straits because of these seemingly innocuous loans.

Here's what happens. The average payday loan charges a fee of about $15 for every $100 borrowed. That might sound like an interest rate of 15%, but that's the fee for a two-week loan. On an annualized basis—which is how most people think about interest rates, or should—that translates into a rate of 391%.

Montel apparently thinks it's unfair to think about it this way, since borrowers are supposed to pay back their loan in two weeks.

But here's the thing: Four out of five payday loans are rolled over or renewed within 14 days. That's because borrowers are not able to pay off their debt in such a short time period, so they go back to the payday loan shop and take out another loan to pay off the first one—for an additional fee, of course—and a cycle of debt begins.

In fact, according to the CFPB, the median payday customer is in debt for 199 days a year, taking out new payday loans along the way as they struggle to pay down the initial loan amount. That's more than 14 times longer than the period Williams was talking about. As a result, more than half of payday loans are made to borrowers who end up paying more in interest than they borrowed in the first place. The median loan recipient ends up paying $458 in fees and an effective interest rate of 130%.

A representative for Williams defended the tweet, telling Money by phone that Williams was specifically referring to loans that are paid off within two weeks, and not payday loans in general.

But since that's a only small fraction of payday loans, we're wondering if Montel accepts only that portion of the fees he gets for endorsing this dangerous lending practice.

The rep also emailed this statement:

As someone who used short term lending while in College, Mr. Williams understands that a large number of consumers, like he once did, have no access to traditional credit products. His endorsement of Money Mutual - which is not itself a lender - is reflective of the code of conduct it requires the lenders in its network adhere to and its historically low complaint rate. Certainly we believe consumers should make sure they fully understand the terms of any financial product they may be considering and would note Money Mutual encourages consumers to fully review and understand the terms of any loan, including the cost of any renewals, offered to them via its network of lenders.

Update: This post initially suggested four out of five borrowers roll over or renew their payday loan within 14 days. In fact, four in five payday loans are renewed within 14 days.