Obama to Wall Street: Stop Acting Like Car Salesmen

It's an issue that's pitted Main Street against Wall Street for years. Now President Obama is wading into the murky question of what ethical duties financial advisers owe their clients when they recommend products like mutual funds and annuities.

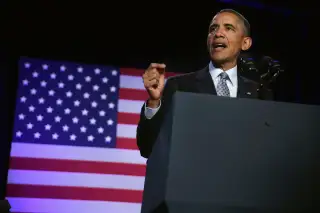

On Monday, President Obama plans to use an AARP event to tout something known as the "fiduciary standard," which would require financial advisers to act in the best interests of their clients, much as a lawyer must do.

That may seem like a no-brainer. But in fact, investment pros who call themselves "financial advisers" currently are not required to give clients the best advice or products that they can offer. They never have been. In the eyes of the law, financial advisers—once more commonly known as stockbrokers—are like car salesmen or the guys selling TVs at the local big box store: They can and do tout products that offer the heftiest profits and commissions.

To be sure, investment advisers have never been allowed to recommend just any investment. Current law requires they sell investments that are "suitable" for their clients based on factors like age or risk tolerance. In practice, however, that often means actively managed mutual funds with hefty sales loads or annuities with complex and expensive guarantees. Compared to low-cost index funds and exchange-traded funds, these investments can end up costing savers tens of thousands of dollars over the years it takes to build a retirement nest egg.

Raising the legal standard to a fiduciary one might stop that practice. That's a big reason that consumer advocates, including the AARP and the Consumer Federation of America, have been calling for years to require all advisers to act as fiduciaries.

Both the Securities and Exchange Commission and the Department of Labor, which has jurisdiction over 401(k) plans, have taken stabs at requiring advisers to become fiduciaries. The issue was a key point of contention in the debate of the 2010 Dodd-Frank financial reform bill. While the bill ultimately included language that appeared to authorize the SEC to implement the financial standard, five years later the proposal is still stalled. One key point of contention: Financial advisers that work on commission tend to take on less wealthy clients. That has allowed Wall Street firms—and especially big insurance companies whose agents sell annuities—to argue that tougher rules would deprive middle class investors of advice.

Of course, it may seem strange that members of Congress would listen to what big business thinks is best for middle class investors while ignoring AARP and the Consumer Federation of America. But that only speaks to the strange ways of Washington—and, of course, to the ingenuity and determination of the financial services lobby.

The White House push appears to focus on advice doled out to investors in retirement plans. While that's a huge group of investors, it's not clear what effect, if any, the proposal would have on advice regarding taxable investment accounts. Any new rules could also be crafted to permit brokers to continue to earn commissions, something that many investors advocates are likely to see as a potentially fatal loophole.