Payday Loan Company Endorsed by Montel Williams Is Fined for Misconduct

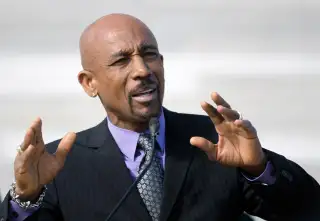

MoneyMutual, a payday loan lead-generator endorsed by former talk show host Montel Williams, will pay a $2.1 million penalty for marketing illegal, high-interest online loans to New Yorkers, the New York State Department of Financial Services (DFS) announced on Tuesday.

Payday lending, the practice of issuing short-term loans at extremely steep interest rates, is illegal in New York State. Unlicensed payday lenders cannot charge an interest rate over 16% per year, and licensed lenders have their annual interest rates capped at 25%. In 2013, the state sent cease-and-desist letters to 35 online lenders making allegedly usurous loans, the majority of whom, authorities say, stopped doing business in the state.

MoneyMutual has acknowledged it advertised loans with an annual percentage rate (APR) of between 261% and 1,304% in New York. According to the DFS, the company also sold "leads" with the personal information of roughly 800,000 New York consumers.

In addition to marketing illegal loan products, MoneyMutual was criticized by the DFS for its use of Montel Williams as an endorser for the firm.

"Using Mr. Williams's reputation as a trusted celebrity endorser, MoneyMutual marketed loans to struggling consumers with sky-high interest rates – sometimes in excess of 1,300 percent – that trapped New Yorkers in destructive cycles of debt," said Benjamin Lawsky, New York's Superintendent of Financial Services, in a statement.

According to the department's investigation, media and sales representatives of Selling Source, which does business as MoneyMutual, "at times assured New York consumers that the lenders to whom it was selling leads were legitimate because 'Montel Williams has endorsed MoneyMutual and would not do so if it were not a legitimate company.'"

Montel Williams has previously come under fire over the high interest rates of the payday loans he endorses. Two weeks ago, when confronted by a Twitter user who noted MoneyMutual loans had annual interest rates of 261% and above, Williams replied, "a 14 day loan has an ANNUAL percentage rate? Maybe get a grip on reality."

As the Department of Financial Services noted in its sanction of Selling Source, payday lenders frequently "target" borrowers who cannot afford to pay off a short-term loan on time, trapping them in a cycle of debt. The federal Consumer Financial Protection Bureau found the median payday customer is in debt for 199 days a year and pays an effective interest rate of 130%.

A former Selling Source CEO told the department at least 55% of MoneyMutual customers are repeat clients. One study by the CFPB found four out of five payday loans are rolled over or renewed.

The DFS claims MoneyMutual's "false and misleading advertisements" did not adequately warn consumers that the policies of its "network of trusted lenders," including interest rates and payment schedules, hurt the ability of borrowers to repay their loans on time, resulting in customers either rolling over their loans or paying off prior loans with new ones.

The department's investigation not only found MoneyMutual's ads to be misleading, but discovered Selling Source targeted repeat clients, referred to as "Gold" customers, who the former Selling Source CEO stated could be more valuable if they took out new loans to pay off prior borrowing.

In a lengthy statement released to the press, Jonathan Franks, a spokesman for Montel Williams, emphasized his client's innocence.

"The DFS has made no finding of a violation of law by Mr. Williams, and the agreement does not require him to pay any fines or penalties," the statement reads. "Mr. Williams and his staff have cooperated fully with the DFS throughout the course of the investigation."

Despite the DFS's sanction, Franks says Williams has not withdrawn his support for MoneyMutual.

"We stand by his overall endorsement of Money Mutual, with the exception, pursuant to the Consent Order, of the State of New York," wrote the spokesman.

Franks also maintained that while "Mr. Williams is not blind to the problems of the industry," most customers were happy.

"As to New York, we note that during the period of time in which Mr. Williams has endorsed MoneyMutual, Mr. Williams has received less than 10 complaints directly from consumers," wrote Franks. "All but one of those complaints was resolved to the consumer’s full satisfaction.