Why Social Security Benefit Rules Are Making Inequality Worse

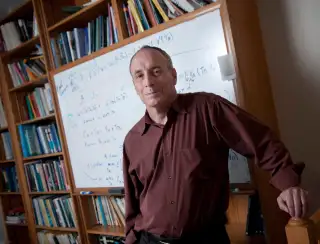

If you find Social Security rules bewildering, don't feel too bad; so do Social Security experts. As Boston University economics professor Larry Kotlikoff points out, the 2,728 Social Security rules, if you print them out, are longer than the federal tax code. Little wonder his new book explaining to how to max out Social Security benefits—Get What’s Yours, co-authored with Money contributor Philip Moeller and PBS journalist Paul Solman—landed on the New York Times and Amazon best-seller lists. Kotlikoff recently spoke to Money about the program’s shortcomings and the best way to claim benefits.

Q: Why are Social Security rules so maddeningly complicated?

A: The system was designed decades ago by older white males who may have had their own interests somewhat at heart. In any case, it awards benefits unfairly. Single people are at a disadvantage to married couples, who have more types of benefits available to them. Married couples with two earners are at a disadvantage to those with one earner. The disabled are also treated unfairly.

Worse, whether you get all the benefits you are entitled to is a random process. It all depends on whether you understand the complex system, and you get the right information from customer representatives, who aren’t well trained. Americans are leaving billions on the table as a result. But higher-income people are better able to take advantage of Social Security’s claiming options. This worsens economic inequality.

Q: You’re an advocate for entitlement reform, yet you’re also encouraging Americans to max out their benefits. Isn’t that contradictory?

A: I want to expose inequities wherever they are. I’ve written about the nation’s generational inequities ["The Coming Generational Storm"], and the expropriation of money that should go to our kids because of the ballooning costs of these programs. But Social Security rules are a disgrace and unfair to people of all ages. No one should get more benefits just because they know the rules.

Q: Given the program’s funding problems, should younger Americans count on Social Security?

A: The system is 33% unfunded, according to the last trustees’ report. So somebody has to pay to fix it. My co-authors and I don’t agree on how to fix things—there’s a debate about solutions in the book. I explain my preferred solution at the Purple Social Security Plan.

Still, I think people 55 and older will get their full benefits. It’s too difficult politically to change their treatment. Younger people will likely receive something, but they’ll probably pay for it with higher taxes.

Q: What is the biggest mistake people make when they claim?

A: For many households, the problem is claiming benefits too early. If you wait to claim till age 70, you can increase your benefits by 76%, compared with starting at age 62, the earliest age you can claim. By delaying, you have an opportunity to tap a source of guaranteed inflation-proof income at an incredibly low price. That said, many people can't afford to wait, since they have no other means of support.

Q: Many financial planners recommend claiming based on your "break-even" age—how long it will take for higher benefits claimed at a later age to exceed what you'd get by claiming early at 62.

A: This is a fundamental misunderstanding. People mistakenly look at Social Security as an investment, and they try to figure out the break-even point, when they’ll make their money back. They don’t understand the economics of working longer, or how to value the extra income you get by waiting.

Social Security is insurance—an inexpensive, safe payout—not an investment. You don’t look at your homeowners' insurance on a break-even basis. You look at the worst-case scenario, which is your house burned down, you have no place to live, and the insurance is there when you need it. The worst-case scenario here is living to 100 and running out of money well before then.

Q: Have you figured out your own Social Security claiming strategy?

In my case, it's relatively straightforward—I can just look at my own book, and I don't need to use my claiming software (MaximizeMySocialSecurity). I'm 64, and I'm older than my ex-wife and my fiancée. They'll both be able to claim spousal benefits on my earnings record. I'm going to wait till age 70, and then collect my benefit.

Read next: The 3 Secrets to Maxing Out Social Security Spousal Benefits