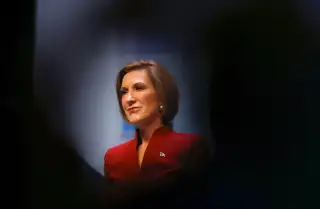

What the Stock Market Thought of Carly Fiorina as a CEO

After a very strong debate performance, a new poll shows former Hewlett-Packard CEO Carly Fiorina has shot into second place among Republican presidential candidates, behind real-estate developer Donald Trump. Like Trump, Fiorina has never held elective offlice. So the two most popular GOP candidates are running strictly on their business records.

As the front runner, Trump has seen his business acumen dissected ad nauseam. (For example, there are those bankruptcies—not for Trump personally, but for some of his businesses.)

Now Fiorina's tenure at Hewlett-Packard from 1999 to 2005 is getting more scrutiny. And unlike Trump, Fiorina ran a public company, which provides one very public measure of how she did.

There are things you can admire about Fiorina's time at HP. She took on a top role in an industry that's still very much a boys' club, and made bold bets—notably buying rival PC maker Compaq. Fiorina points out she boosted sales, cash flow and "rate of innovation."

Read Next: 8 Epic Business Failures With Donald Trump's Name on Them

But looked at purely as a stock, HP was a real loser for investors when Fiorina ran it, losing about half its value on the market.

It's important to emphasize that the tech-stock bubble peaked and then burst not long after she took the job. Not many tech CEOs of her era could point to a rising stock price. But as Yale School of Management professor Jeffrey Sonnenfeld argues in a new piece in Politico, HP struggled even relative to the broad stock market and other tech companies. Sonnenfeld is a longtime critic of Fiorina as a CEO, and Trump cited him in the second Republican debate.

Here's how HP performed during Fiorina's nearly six-year tenure, compared with both the broad S&P 500 index and the technology-heavy Nasdaq.

So what exactly happened? Part of it was that Fiorina's marquee Compaq acquisition, which was controversial from the start, proved slow to boost profits. Perhaps the bigger factor: During Fiorina's tenure, the PC business seemed like a tech industry juggernaut. Since then, the rise of products like the iPhone and tablet computers have changed the way Americans work and surf the Web, leaving PCs in the dust.

Of course, CEOs can leave a long legacy, and if you take a slightly longer view, it's possible to see what she did in a more favorable light. Fiorina's successor Mark Hurd largely stuck with Fiorina's strategy. Bloomberg View's Justin Fox argues argues that if you compare HP's stock to other companies in the ailing computer hardware business, and then measure the results to the end of Hurd's tenure, you can call the Fiorina-Hurd strategy "a relative success."

Of course, that's a pretty nuanced argument on which to build a political campaign.

Read Next: Donald Trump Would Be Billions Richer If He'd Invested in Index Funds