When It's a Bad Idea to Play It Safe With Your Investments

Sometimes the best way to grasp a complex concept is with a simple picture. “Big Ideas in Simple Sketches” offers illustrated insights from some of the best minds in money. The drawings may look pretty basic, but the thinking behind them will ultimately make you a better investor.

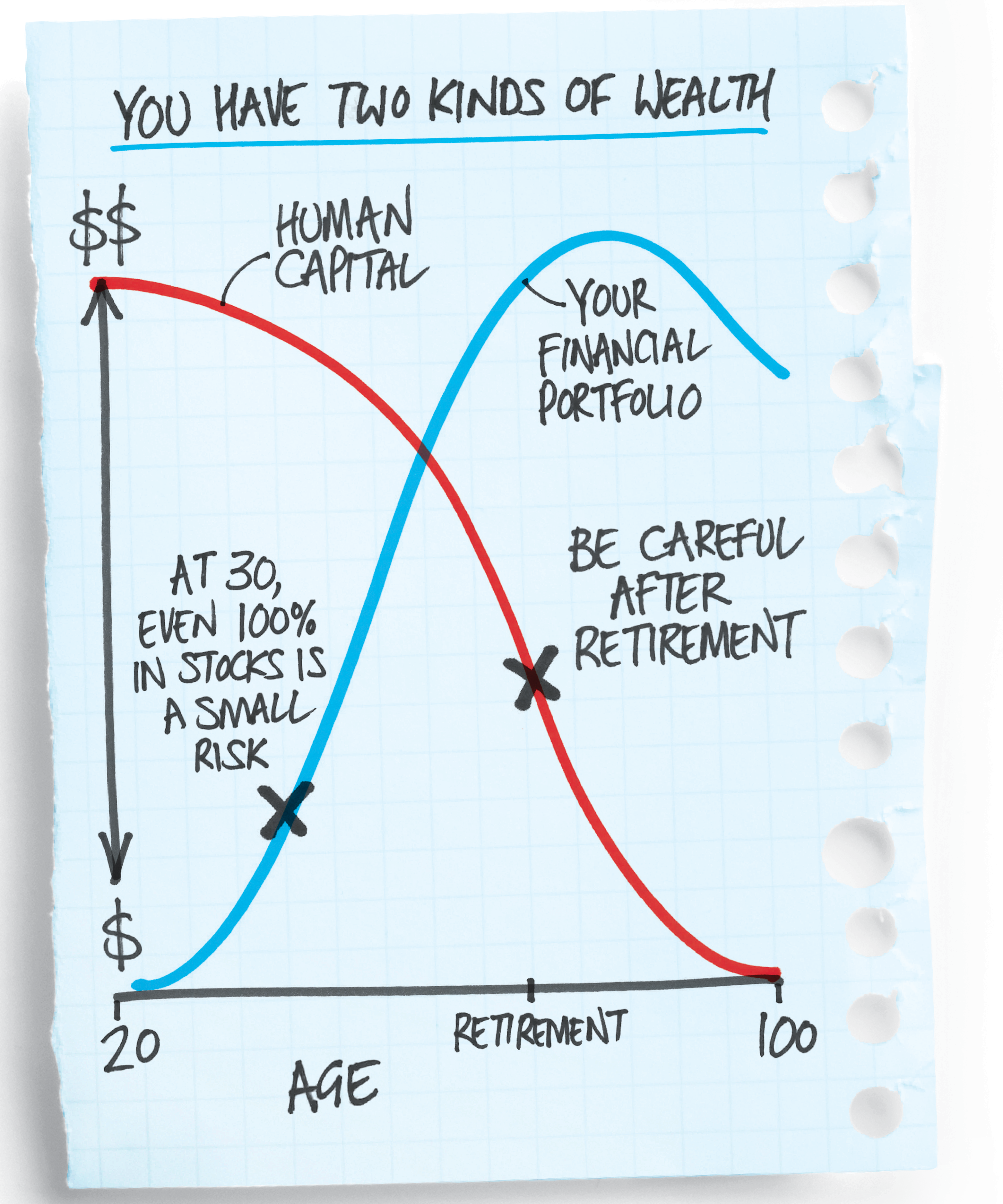

Surveys show that America's young workers are disinclined to own stocks. But early in your career, assuming you've already set aside emergency savings, even risky stocks can be safer than they seem. That's because your financial portfolio is a comparatively small part of your total wealth.

"The largest asset you have when you're younger is human capital," says Morningstar's David Blanchett, who created the example above. Human capital is basically your ability to earn income, and when you are young you can bet you have lots of years of salary ahead of you.

Read Next: Why Stock Market Losses Feel More Extreme Than Gains

Later, protecting your financial portfolio takes precedence as your earning potential falls off. You have to be more conservative with your holdings in retirement, because your nest egg (plus Social Security) is what you'll rely on.