Here Are the New Tax Brackets for 2019 — See Where You Land

The 2017 Tax Cuts and Jobs Act was the biggest overhaul of the U.S. tax code in decades. Among the changes was an adjustment to 2019 tax brackets, which determine the rate at which your income is taxed.

Of course, doing your taxes is a lot more complicated than just applying your tax bracket to your salary. You also have to factor in adjustments, like deductions and credits. And because tax rates are marginal you only end up paying your top rate on part of your salary. But federal tax brackets have a big symbolic importance for the way Americans think about taxes. No wonder freshman Congresswoman Alexandria Ocasio-Cortez recently proposed a top 70% tax rate on Americans earning more than $10 million a year.

The Tax Cuts and Jobs Act keeps the basic structure of the U.S. tax system in place. There are still seven income tax brackets, with all but the bottom rate (10%) being lowered and all of the corresponding income thresholds were adjusted, too. For instance, in 2017 the third highest tax bracket was 33% for an income range of $191,650 to $416,700, and for 2019 the third highest bracket is 32% for incomes between $160,726 to $204,100.

This year, the highest federal tax bracket was lowered from 39.6% to 37% for incomes of $510,301 and higher for single filers.

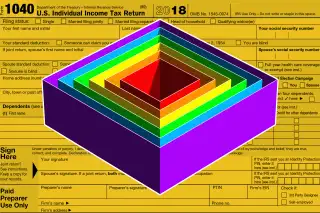

The chart below spells out the 2019 tax brackets and their income thresholds: