Own an Index Fund? You're Making a Big Bet on Tech

It's been a great decade for technology stocks. That means if you own an index fund, you could be making much bigger bet on the tech sector than you realize.

It's no secret the economy changed dramatically during the 2010s, as gadgets like smartphones and services like streaming TV took hold. Indeed, Netflix, which returned nearly 4,000%, was the decade's top-performing stock.

But that success means tech and tech-related stocks now represent a much larger share of stock market indexes like the S&P 500 than they did a few years ago. The size of a given company's position in an index is determined by its market value, which is the total price of the company's outstanding stock shares. So as a company's stock price increases, the company occupies more space in the index. For investors who own funds designed to mirror these indexes, tech stocks have similarly become a much bigger part of your investment portfolio.

Tech Stocks Balloon

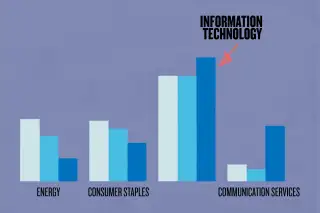

Just how, big? As of year end, information technology and "communications services" stocks — a category that includes telecom stocks like Verizon, as well as Netflix, Facebook and Google-parent Alphabet — made up 34% of the S&P 500, up from about 23% a decade ago. That means if you own an index fund, these tech and communications stocks represent roughly a third of your stock-market investments.

Those gains have come at the expense of some venerated "hard-hat" sectors like energy, which represented 12% of the market a decade ago, and now accounts for less than 5%, and consumer staples which has shrunk from 11% to about 7%.

What to Do Now

Just because index funds are tech-heavy doesn't necessarily mean you should take action. After all, the point of index investing is to outsource that decision making to the wisdom of markets.

But for investors who actively oversee their portfolios, tech stock's big run could suggest those stocks are overvalued. Right now, the average technology stock in the S&P 500 trades at 23 times earnings, compared to about 19 times for the market as a whole and 17 for energy stocks.

As a result, it could be time to shift investment dollars to so-called "value" funds, which focus on stocks with low prices relative to earnings, sales or other measures. Money's list of 50 Best Mutual Funds, includes several, such as Dodge & Cox Stock and Schwab Fundamental U.S. Large Company Index.