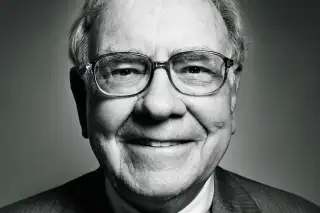

Inside Buffett's Brain

Warren Buffett isn’t merely a great investor. He’s also the great investor you think you can learn from, and maybe even copy (at least a little).

Buffett explains his approach in a way that makes it sound so head-smackingly simple. The smart investor, he wrote back in 1984, says, “If a business is worth a dollar and I can buy it for 40¢, something good may happen to me.” This is particularly true if you add an eye for quality.

Buying good businesses at bargain prices — that sounds like something you could do. Or hire a fund manager to do for you, if you could find one with a fraction of Buffett’s ability to spot a great deal. Of course, the numbers say otherwise. The vast majority of U.S. stock funds fail to beat their benchmarks over a 15-year period.

Buffett’s long-run record makes him a wild outlier. Since 1965 the underlying value of his holding company, Berkshire Hathaway, which owns publicly traded stocks such as Coca-Cola and American Express , as well as private subsidiaries like insurance giant Geico, has grown at an annualized 19.7%. During the same period the S&P 500 grew at a 9.8% rate.

Buffett is “a very unexplained guy,” says Lasse Heje Pedersen of Copenhagen Business School in Denmark. But instead of chalking up Buffett’s success to what Pedersen calls Fingerspitzengefühl—German for an intuitive touch—the professor is out to explain the man through math. His research is part of a push among both academics and money managers to quantify the ingredients of investment success. The not-so-subtle hint: It may be possible to build, in essence, a Buffett-bot portfolio. No Oracle required.

In an attention-getting paper, Pedersen and two co-authors from the Greenwich, Conn., hedge fund manager AQR claim to have constructed a systematic method that doesn’t just match Buffett, but beats him (Pedersen also works for AQR). This is no knock on the man or his talents, they say. Just the opposite: It proves he’s not winging it. Meanwhile, other economists say they have pinned down a simpler quantitative way to at least get at the “good business” part of Buffett’s edge.

A dive into this quest to decode Buffett, 83, certainly can teach you a lot—about Buffett’s investing and your own. Yet this story isn’t just about what makes one genius tick. It’s also about how Wall Street is using modern financial research, especially the hunt for characteristics that predict higher returns, to sell you mutual and exchange-traded funds. If you wonder how the world’s greatest investing mind can be distilled to a simple formula, you’re right to be skeptical. That’s one message even Buffett himself (who declined to comment for this story) would most likely endorse.

The Buffett equation starts with value, but not “bargains”

The AQR authors say a big part of “the secret behind Buffett’s success is the fact that he buys safe, high-quality, value stocks.” Hardly a surprise, since Buffett has been called the “ultimate value investor.” But the truth is that Buffett is no classic bargain hunter. Can an equation replicate this fact?

In his Berkshire shareholder letters, Buffett often writes about the influence of Ben Graham, his professor at Columbia. Graham is considered the father of value investing, a discipline that focuses on buying a stock when it is cheap relative to some measure of the company’s worth. Graham especially liked to look at book value, or assets minus debt. It’s what an owner would theoretically get to keep after selling all of a company’s property.

Economists have come to back this idea up. In the 1990s, Eugene Fama and Kenneth French showed that stocks that were cheap vs. book provided higher returns than old economic models predicted. (Fama shared the Nobel Prize for economics in 2013.)

Buffett certainly buys his share of textbook value plays: Last year Berkshire snapped up the beaten-down stock of Canadian energy producer Suncor at a price that was just a little above its book value per share. (The typical S&P 500 stock trades at 2.6 times book.) But since 1928, a value tilt would have brought investors only an extra percentage point or so per year. There’s more to Buffett than the bargain bin.

Buffett says so himself. He likes to cite the maxim of his longtime business partner, Charlie Munger: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” In his 2000 shareholder letter, Buffett wrote that measures including price/book ratios “have nothing to do with valuation except to the extent they provide clues to the amount and timing of cash flows into and from the business.” A stock being cheap relative to assets helps give you what Graham called “a margin of safety,” but what you really want a piece of isn’t a company’s property but the profits it is expected to produce over time.

Those anticipated earnings are part of what Buffett calls a company’s “intrinsic value.” Estimating that requires making a smart guess about the future of profits, which Buffett does by trying to understand what drives a company’s business. His arguments (at least his public ones) for why he likes a stock usually involve a straightforward story and are arguably a bit squishy on the numbers. Coca-Cola has a great brand, he says, and has customers who are happy to drink five cans a day.

“The best buys have been when the numbers almost tell you not to,” he said to a business school class in 1998. “Then you feel strongly about the product and not just the fact that you are getting a used cigar butt cheap.” Some economists, though, think there may be a way to get the numbers themselves to tell the story.

Predicting wonderfulness

Since the discovery of the value effect, as well as a similar edge for small companies, academics have looked for other market “anomalies” that might explain why some stocks outperform. The AQR team thinks that a trait it calls “quality” might explain another part of Buffett’s success. Their gauge of quality is a complex one that combines 21 measures, including profits, dividend payouts, and growth, but a lot of it certainly rhymes with what Buffett has said about the importance of future cash flows.

There may be a far simpler way to get at this. Last year the University of Rochester’s Robert Novy-Marx published an article in the influential Journal of Financial Economics arguing that something called a company’s “gross profitability” can help explain long-run returns. He says a theoretical portfolio of big companies with a high combined score on value and profits would have beaten the market by an annualized 3.1 percentage points from 1963 through 2012.

Novy-Marx’s gross-profit measure is sales minus the cost of goods sold, divided by assets. That is different from the earnings figures most investors watch. It doesn’t count things like a company’s spending on advertising or a host of accounting adjustments, which might be important to Wall Street analysts trying to grasp the inner workings of a single company. “I view gross profits as a measure that is hard to manipulate and a better measure of the true economic profitability of a firm,” Novy-Marx says.

In a recent working paper he also suggests that gross profits may be an indicator a company has a quality prized by Buffett: a wide economic “moat.” Businesses with this trait (say, Coke’s brand) enjoy a competitive advantage that helps them defend their high profits against the competition.

Recently Fama and French confirmed that a profit measure similar to Novy-Marx’s also seemed to work. All of which adds to the case that Buffett’s value-plus-quality formula makes sense. But it doesn’t exactly describe what’s in the Berkshire portfolio.

A risky take on safety

AQR believes that there’s one more anomaly that Buffett exploits: safety. Here again, though, Buffett relies on a very particular kind of safety. Stocks that fall less in downturns—“low beta” is the jargon—are likely to be underpriced, says AQR. It has to do with investors’ reluctance to use borrowed money, or leverage in Wall Street parlance. When they want to increase potential returns, most investors don’t turn to leverage to amp up their market exposure. Instead, they buy riskier, “high beta” equities. That drives up the valuations on shares of highfliers, giving cheaper, low-beta stocks an edge.

It’s unlikely Buffett ever asks what a stock’s beta is. (He often pokes fun at beta and other Greek-letter notions.) Still, he does tend to shy away from many of the glamour stocks bulls love. He famously avoided, for example, the Internet bubble of the late 1990s. “A fermenting industry is much like our attitude toward space exploration: We applaud the endeavor but prefer to skip the ride,” he wrote in 1996.

Don’t mistake Berkshire Hathaway for a safe stock, though. From the summer of 1998 through early 2000, Pedersen and company note, Berkshire shares fell 44% while the market rose 32%. What explains that? First, low beta doesn’t mean an investment won’t lose money—just that it won’t fall sharply in step with the market. (Gold, for example, is volatile but has a low beta to stocks.) Second, Berkshire concentrates on a fairly small group of stocks with big bets on certain industries, such as insurance. So if one sector stumbles, it has a large effect on the entire company.

Then there’s leverage, which Buffett isn’t afraid of. The AQR team says Buffett is a smart user of other people’s money, which increases Berkshire’s gains but can also magnify losses. This part of Buffett’s advantage also happens to be the one that would be hardest to replicate.

A big chunk of the Berkshire portfolio is in insurers it wholly owns. As Buffett has explained, this is an excellent source of cheap leverage. Insurers enjoy a “float”—they take in premiums every month but pay out only when someone crashes a car, gets flooded, or dies. For Berkshire, says AQR, this historically turned out to be like getting a loan for 2.2%, vs. the more than 5% the U.S. government had to pay on Treasuries over the same period.

Buffett was able to combine this cheap debt with another unique advantage: Even in down periods no one ever forced him to sell stock at fire-sale prices. Fund managers, on the other hand, face that risk all the time, and the ones who use borrowed juice have to worry about being hit by a cash crunch in a bad market. To simulate Buffett’s strategy in a far more diversified portfolio, the AQR model levers up 3.7 to 1, vs. Berkshire’s 1.6 to 1. As it turns out, it’s easier to build a Buffett portfolio in theory than to run a company like Berkshire in real life.

And Pedersen admits that quants can only hope to say what it looks like Buffett did. They can’t describe how his neural wetware figured it all out. “People say, ‘That’s not how Buffett does it,’ ” says Pedersen. “We agree. We don’t think that’s how he looks at it.” When Buffett bought Burlington Northern Santa Fe outright a few years ago, he was making an entrepreneurial bet on rising oil prices, reasoning that trains use less fuel than trucks. Great story. Hard to stick into a quantitative model.

Here come the robofunds

Finding factors that beat the market isn’t just an academic exercise. There is a huge rush to create funds exploiting one or another stock market anomaly. AQR, for instance, has launched funds using both low-volatility and high-quality screens. Dimensional Funds, which runs low-cost index-like portfolios, has added a profitability tilt to some funds. (Novy-Marx recently began consulting for Dimensional.)

A trio of researchers at Duke has counted up to 315 new factors that have supposedly been discovered by academics, with over 200 popping up just in the past decade. They can’t all work—and the Duke team says that it is statistically likely that most of them won’t. What those factors all have in common is that they were discovered by looking backward.

As Joel Dickson, an investment strategist for the index fund giant Vanguard, says, “Predicting the future is a lot harder than predicting the past.” A cynic can easily mine past data for patterns. To dramatize that effect, Dickson put together data showing you could double the market’s return just by picking S&P 500 stocks with tickers starting with the right letters of the alphabet. If you like Buffett, try the WARREN stock portfolio above—click the image above to enlarge. (It “works” largely because holding stocks in equal proportion means a bigger bet on smaller companies, which happen to have had a good run.)

“Data mining is hugely pernicious, and the incentives to do it are high,” acknowledges Novy-Marx. He says profitability is nonetheless an unusually strong effect and simple enough that it’s not easy to game. Pedersen, likewise, says the safety factor is grounded in theory going back to the 1960s. In the end, though, you can never know whether what worked in the past will keep working in the future.

So what do you do with all this? Samuel Lee, an ETF strategist at Morningstar, says some of these new factors look promising. He has even called this a “come-to-Buffett moment” for academic finance. But he says it’s important to go in with modest expectations. Strategies that have had success are likely to look more average over time, especially once they are publicized and people trade on them. “Your main protection is just to keep fees low,” he says. “You can’t pay up for these factor tilts.” He says a factor-based fund charging as little as 0.70% of assets per year could easily see most of its performance advantage consumed by fees.

The quest to replicate Buffett’s strategies may be an attempt to improve the chances of success for active management. In the end, though, it helps illustrate how hard it is for most professional managers to truly outperform. Put simply, “Should a value manager be getting credit for having a value tilt in a value market?” asks Dickson, rhetorically. Likewise, if a combo of value, profits, and safety can explain a lot of what even the most dazzling managers do, and if it gets easier to simply add more of those elements with low-cost index funds, the fees of 1% or more that many active funds charge are hard to justify.

In short, it may not be worth it for you to try to find the next great money manager. This is a point that Buffett himself has made time and again. In a 1975 letter to Washington Post CEO Katharine Graham, he wrote, “If above-average performance is to be their yardstick, the vast majority of investment managers must fail. Will a few succeed—due to either chance or skill? Of course. For some intermediate period of years a few are bound to look better than average due to chance—just as would be the case if 1,000 ‘coin managers’ engaged in a coin-flipping contest.”

Of all the investment insights that Buffett has laid out over the years, perhaps the most widely useful one is found in his latest Berkshire shareholder letter. There, he says, his will leaves instructions for his trustees to invest in an S&P 500 index fund.