Why Prosecutors Don't Target Thieving CEOs

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

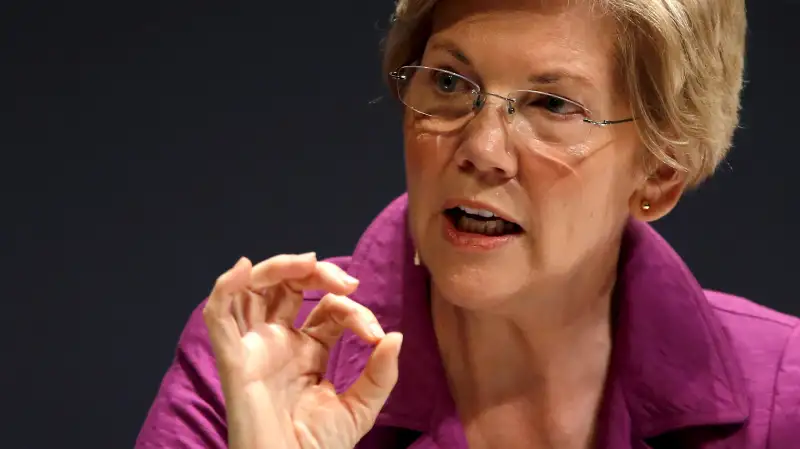

Massachusetts Senator Elizabeth Warren issued a stinging broadside against federal prosecutors on Friday, charging U.S. courts with throwing the book at mixed-up teenagers, while letting wealthy corporate executives who commit much larger and sometimes deadly crimes off with essentially no chance of punishment.

In a new report, Sen. Warren's office makes the case that CEOs and other top executives simply don't face the same legal consequences as ordinary Americans, releasing a list of what it claims are 20 examples of corporate criminal and civil cases that prosecutors failed to pursue to the full extent of the law last year.

Among the cases: scandals ranging from General Motors' years' long cover up of ignition switch problems to currency manipulation by large banks (including Citigroup and J.P. Morgan), to a mine explosion that killed 29 people -- the only instance of misconduct which led to a conviction of a corporate executive, according to Warren.

The problem, the senator argues, isn't the way U.S. laws are written. Rather it's that, despite repeated promises, the Obama Administration hasn't made prosecuting corporate bigwigs a priority. She goes so far as to make the case that such selective application of the law undermines the government's moral authority: "If justice means a prison sentence for a teenager who steals a car, but it means nothing more than a sideways glance at a CEO who quietly engineers the theft of billions of dollars, then the promise of equal justice under the law has turned into a lie," Warren charges in the report.

As a moralist, Warren may well have point. But, as politicians tend to do, she is also over-simplifying. Many prosecutors would love nothing more than to cuff a dishonest Wall Street trader or arrogant CEO, for the same reasons as Warren or even simply to burnish their resumes. For proof, just look at the career of former New York governor Elliot Spitzer, who rose to prominence due to his tough-on-finance record, or for that matter, the plot of Showtime's new drama 'Billions.'

But white collar prosecutions are notoriously expensive and risky. After all, fat-cat CEOs often come flanked with expensive lawyers and their cases often hinge on mind-numbingly arcane legal principles.

Even the most vigorous prosecutors can fall victims to such difficulties. Starting in 2009, Manhattan U.S. attorney Preet Bharara racked up a string of insider trading convictions against Wall Street executives, at one point winning 85 straight cases. But even Bharara's run of victories eventually stopped short of what many considered to be their ultimate target, hedge fund magnate Steven A. Cohen. What is more, a number of Bharara's most significant convictions were eventually overturned when a Federal appeals court unexpectedly re-interpreted the contours of insider trading law, setting defendants free.

It's not just a problem in the U.S. In fact, earlier this week, U.K. prosecutors, after winning an initial conviction in their quest to prosecute bankers accused of fixing LIBOR -- a key benchmark central to financial markets -- failed to secure any further wins. While prosecutors had seemed confident in their case, the jury took just two days acquit all six additional defendants. The acquittal led to questions about whether the U.K.'s Serious Fraud Office -- which had handled the prosecutions -- will survive the humiliation.

All this isn't to say corporate malfeasance isn't indeed going unpunished, or that Warren is wrong to use her bully pulpit to call attention to it. But the situation won't be easy to fix.