Can You File Taxes for Free With TurboTax? It's Especially Complicated This Year

If you're among the millions of Americans who rely on TurboTax to file their annual income taxes, you could be in for an unpleasant surprise this spring.

For the first time in years, Intuit-owned TurboTax is not part of the IRS Free File program. Free File is a partnership between the government and several tax prep services that allows people to draw up and, in some cases, submit their federal tax returns online for free. Though Free File is notoriously underutilized, it's typically stacked with name-brand offers from recognizable companies — TurboTax included.

Until now.

Why isn't TurboTax part of IRS Free File anymore?

TurboTax announced in a blog post last July that it was not renewing its role with IRS Free File due to its limitations and "conflicting demands from those outside the program" that leave it unable to continue participating while still delivering "all of the benefits that can help consumers make more money, save more, and invest for the future."

However, the company vowed not to give up on free tax filing options. TurboTax said it processed 17 million free tax filings last season; of that, only 3 million came through the Free File program.

"Moving forward, Intuit is committed to continuing to offer free tax preparation while accelerating innovation to address all of consumers’ financial problems," it added.

It's worth noting that TurboTax came under fire a few years ago for using code that hid its Free File page from Google results, as reported by ProPublica. It later changed the code.

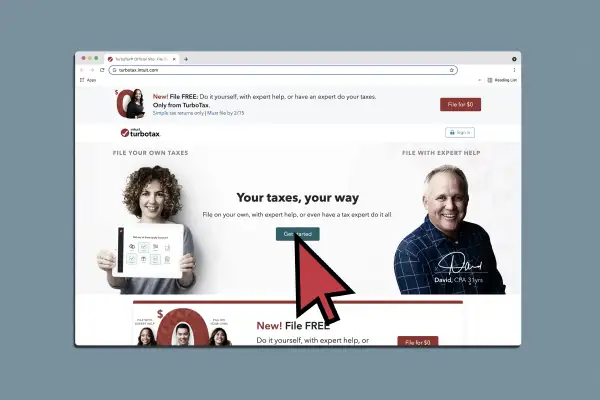

How to file taxes with TurboTax for free

Even though TurboTax has left the IRS Free File project, it does still have no-cost options. It is possible to file for free through TurboTax — but there are a slew of requirements you must meet.

For example, TurboTax Free Edition, TurboTax Live Basic, and TurboTax Live Full Service Basic are all free right now — but only if your return is simple. (Note that TurboTax defines "simple" as "Form 1040 only" and that not all taxpayers qualify.) These cover W-2 income, limited interest and dividend income, the standard deduction, the earned income and child tax credits, and student loan deduction.

If your taxes are more complex, including items like unemployment income, stock sales or rental properties, you'll likely have to upgrade.

Assuming your situation is simple enough, you can file one federal and one state tax return without charge, but you have to move fast. TurboTax Live Full Service Basic — in which a tax expert does your taxes for you — is only free until Feb. 15. The free TurboTax Live Basic offer — which comes with live, on-demand expert help — lasts through March 31.

If you're fine to file DIY, the TurboTax Free Edition will be "available the entire season," according to a news release.

The deadline for most Americans to file their taxes this year is April 18.

Filing taxes for free with other services

TurboTax isn't the only service to drop out of IRS Free File recently. H&R Block left the project in 2020.

Even so, IRS Free File is still plugging along. If your adjusted gross income is $73,000 or less, you're eligible for free guided tax prep from options like Tax Slayer, FileYourTaxes.com and TaxAct. If your income exceeds that, you qualify for free fillable forms (but you'll have to actually file them on your own).

Experts generally recommend starting your taxes early so as to avoid software snafus, refund delays and identity thieves. If you're not opting for IRS Free File, there's also a financial reason to avoid procrastinating: Tax prep fees tend to rise the closer Tax Day gets.

More from Money:

Getting Your Tax Refund May Take Way Longer Than Usual This Year

2022 Tax Brackets: How Record-Breaking Inflation Will Affect Your Taxes