Is There a 'Best' Time to File Your Taxes?

Welcome to Dollar Scholar, a personal finance newsletter written by a 27-year-old who’s still figuring it out: me.

Every week, I talk to experts about a money question I have, whether that’s “What if I don't have a 401(k)? or “How many credit cards do I need?” As I learn, I share simple ways to improve your financial life… and post cute dog photos.

This is (part of) the 28th issue. Check it out below, then subscribe to get future editions of Dollar Scholar every Wednesday.

Ever since elementary school, I’ve suffered from chronic overachiever syndrome.

I used to thrive as the teacher’s pet, clapping erasers and asking “Are you going to collect the homework?” whenever they forgot. I finished tests early so I could write stories on my AlphaSmart. I once broke my arm playing kickball because I kicked the ball *too* enthusiastically. (I wish I was kidding.)

I’ve loosened up slightly as an adult, but I still like to cross my t’s and dot my i’s. My internet bill is due on the 30th every month, but I always pay it on the 25th. I show up early for concerts. At bottomless brunch, I set a timer on my phone so I know when I’m near the 90-minute mark.

Insufferable? Yes. But also efficient.

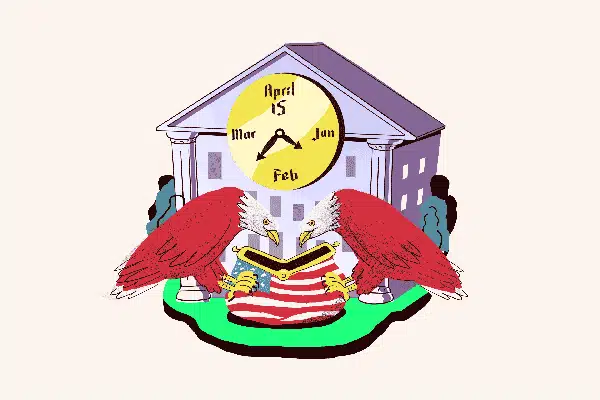

Recently, I’ve been wondering whether I should apply my Type-A tendencies to tax season. I got my Form W-2 in the mail the other day, but the deadline isn’t until April 15. When is the best time to do my taxes? Will I get a gold star if I do them early?

I called Barbara Weltman, editor of J.K. Lasser's Your Income Tax 2020, for tips. She told me that the first thing I need to consider is whether I have all the necessary documents.

My employer had to send my W-2 by Jan. 31, but apparently that’s just the beginning. I’ll need 1099s if I have investment or freelance income, a W-2G if I have gambling winnings and 1098s if I have a mortgage or student loans.

From there, it’s really up to me as to when I do my taxes. According to Weltman, as long as I file or request an extension by the IRS’s April 15 due date, I’m fine.

“If you don’t know if you’re getting a refund or are going to owe taxes, the key deadline is the filing deadline,” she says. “If you think you’re going to get a refund, the sooner the better.”

Refunds are a divisive topic in the personal finance world. Though they may seem sweet, they’re actually what Weltman calls an “interest-free loan to the government” because the funds come from my paycheck.

If my refund is big, it probably means I’m withholding too much throughout the year. That’s not abnormal — a Credit Karma survey found that about half of people expect to get refunds over $1,000 this year — but it’s not a great practice.

Another note on refunds: The IRS sends out 90% of them within three weeks of filing. However, if I’m planning to claim the Earned Income Tax Credit or Additional Child Tax Credit, those won’t be issued before mid-February.

Back to tax timing. One factor that might change my situation is whether I’m using a paid preparer like H&R Block. As Weltman pointed out, their calendars fill up fast, so it might be smart to make an appointment before everyone else does.

To give you an idea of how busy it gets, last year the IRS expected to get 153 million individual tax returns. As of April 12, it said 50 million people still hadn't filed.

I personally don’t use an IRL tax preparer, but I should still keep an eye on the calendar. Some tax software systems increase their prices as the season wears on. Last year, for example, TurboTax hiked its Deluxe and Premier tiers by $20 on March 1.

Luckily, though, most people can file for free.

Bottom line? When I do my taxes is my decision, as long I have all my documents and my return is ultimately filed by April 15. (Extensions are an exception with a whole other set of rules.)

With that in mind, “the sooner you file, the sooner you’re going to get your money back,” Weltman says.

It comes down to personal preference, but one final myth Weltman wants to dispel is that filing early = higher chances of being audited. That’s simply not true.

More From Money:

The Best Credit Cards Right Now