Biden Aims to Spur Economic Competition — and Lower Prices — With New Task Force

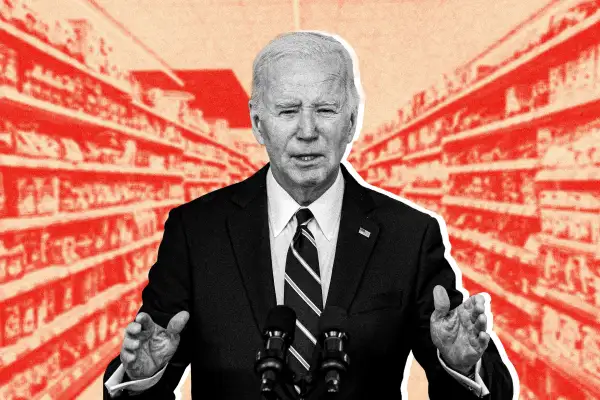

As the Federal Reserve continues to work on curbing inflation, the White House is attacking the high prices stretching Americans' budgets in another way: with a new "strike force."

President Joe Biden announced the interagency effort, formally called the Strike Force on Unfair and Illegal Pricing, on Tuesday. According to a fact sheet, its mission is to "root out and stop illegal corporate behavior that hikes prices on American families through anti-competitive, unfair, deceptive or fraudulent business practices."

The ultimate goal? Billions in savings on junk fees, plus lower prices on everyday goods like gas and groceries.

The task force will be led by the Department of Justice and the Federal Trade Commission — which Jared Bernstein, chair of the U.S. Council of Economic Advisers, tells Money is noteworthy because the agencies have the "legal wherewithal to go after illegal pricing behaviors." With fewer silos and more data-sharing between departments, the hope is that the task force will be better able to crack down on wrongdoing.

"There is more going on in the space than we've been able to block thus far, and so we're going to ramp up our efforts," Bernstein says.

How competition drives down prices

Biden has made competition a key part of his economic agenda recently. Last year, for instance, the administration sued to block a merger of JetBlue and Spirit Airlines (the firms announced this week that their plans had been called off). Last month, the FTC moved to stop grocery giant Kroger from acquiring Albertson's.

"When companies compete for your business, they are more likely to lower costs and improve quality," Lael Brainard, director of the National Economic Council, tells Money. "We've seen historically, when there's more competition, consumers get a better deal."

Brainard says the supply chains were broken by the pandemic when Biden took office, and the situation was exacerbated by Russia's invasion of Ukraine in 2022. These pressures, combined with consumers' pent-up demand, led inflation to spike.

But this has since abated.

Though it remains above the Fed's long-run target of 2%, inflation has fallen from its June 2022 peak of 9.1%. As of January, the consumer price index was up 3.1% year over year.

"Supply chains are now back to normal, and a lot of costs for businesses are also down," Brainard adds. "But some companies are not passing savings on to consumers."

Affording day-to-day spending remains top of mind for many Americans: In poll results released Tuesday by personal finance company Achieve, 66% of respondents said "making ends meet" was one of their top financial concerns that could be affected by the upcoming presidential election.

These themes — of competition, affordability and fair pricing — are expected to be part of Biden's Thursday State of the Union address, but not everyone agrees with the administration's approach. The Wall Street Journal's editorial board pushed back against the White House's strike-force reveal, writing that the administration should instead consider "rolling back burdensome government regulation that is raising prices."

As an example, the board highlighted a new rule from the Consumer Financial Protection Bureau intended to slash credit card late fees, which — in combination with its overdraft-fee crackdown — the board said "will reduce the availability of free checking."

For its part, the CFPB has estimated the rule will save Americans $10 billion a year.

More from Money:

17 Best Credit Cards of March 2024

Credit Card APRs Hit a Record High — and Critics Blame ‘Greedflation’

Biden's Junk Fee Crackdown Comes for Shady Retirement Advisors