Apple Pay Is Here — and There's Just One Big Problem

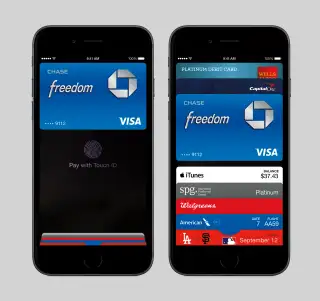

On Tuesday, Tim Cook took the stage to announce — in addition to a few other things you may have heard about — a brand new mobile payments service called Apple Pay. Instead of swiping a credit card, users of the service will swipe their iPhones (or Apple Watches), which can be preloaded with customer's debit and credit cards using the Passbook application.

Having one phone to rule all our cards sounds pretty great, and Apple is certainly positioned better than any other company to make mobile payments finally catch on. But there's one issue the company still has to surmount before it can kill off plastic for good: Right now, the vast majority of retailers lack the technology to accept the company's new payment service.

As CEO Tim Cook acknowledged during Apple's announcement, only 220,000 stores will work with Apple Pay out of the gate. That's about 2.4% of the roughly 7 million to 9 million merchants in the U.S. that accept credit cards. The remaining 97.6% of businesses do not have point-of-sale systems that work with near-field communication (NFC), the technology Apple Pay relies on. Merchants will have to upgrade their checkout process for Apple's service to catch on, and the expense of such an endeavor has—thus far—left many businesses reluctant to do so.

Michael Archer, a partner leading the Global Financial Services practice at Kurt Salmon, thinks the major indicator of whether an Apple payment service will succeed is the number of locations prepared to accept NFC. According to Archer, who spoke to Money just before Apple Pay was announced, the service would need to be usable at about 20% of U.S. retail locations to reach critical mass of acceptance. So far, Apple isn't close to hitting that number.

However, Archer points out that credit card companies may have an incentive to help stores acquire NFC technology to give their own cards an edge. "This could be a way to lock someone into the card if you can make it extremely convenient to use in the device," said Archer. Another development he thinks could work in Apple's favor is that merchants will soon be forced to upgrade their point-of-sale systems to accept EMV, a new card technology meant to reduce fraud. Card companies have given their customers until 2015 to make the transition, with laggards bearing increased liability for credit card fraud, but stores have dragged their feet. With the deadline approaching, more merchants may finally decide to upgrade and choose to add in NFC compatibility while they're at it.

But not all experts are rosy on Apple's chances for mobile payment domination—at least in the near term. George Wallner, co-founder and CTO of LoopPay, an Apple Pay competitor that uses existing point-of-sale infrastructure for mobile payments, predicts a slow acceptance of Apple Pay, and other NFC-dependent services like Softcard and Google Wallet. While Wallner was impressed by Apple's demonstration, he says it will take more than the promise of Apple compatibility to get merchants to change their ways, especially when the status quo works just fine. "It's not an easy change," says Wallner. "It is a long, drawn-out, careful, extensive process. It can take six to eight months to even certify a new system. Retailers look at the bottom line, and they see nobody is offering a financial incentive for them to change." According to the LoopPay founder, even increased fraud liability may not be costly enough to spur a jump in NFC adoption.

That said, Wallner believes that over time, merchants will gradually upgrade their equipment to support Apple Pay. In a decade, he sees NFC having significant market penetration and co-existing with both older and newer payment technology.

One feature that might convince merchants to upgrade ahead of schedule would be a way for businesses to use Apple Pay to reward loyal customers. According to Archer, a slightly more convenient way to pay, by itself, doesn't provide enough value to customers or merchants to force a change in behavior. Integrating loyalty programs into Apple Pay, on the other hand, would give merchants a reason to upgrade their terminals and consumers a reason to use the service. Passbook, which powers Apple Pay, also integrates with multiple retailers' loyalty cards.

Apple "is going to be playing on the cool factor on the first round of this," said Henry Helgeson, CEO of Merchant Warehouse, a company that helps retailers implement mobile payments. "The real value is when merchants can put loyalty in those wallets and get repeat business. It's something that they know and retailers know is very important to them. We're going to see version 2.0 with some of those things."

Overall, Helgeson anticipates Apple Pay being a huge success. His company recently outfitted 3,000 retailers with upgraded point-of-sale systems that included an NFC reader. "I'm pretty happy about that decision right now," said Helgeson.