Dave Ramsey Warns Against Making These 3 Costly Money Mistakes When You’re Over 50

It’s important to have a financial plan at any stage in life, but when you’re nearing retirement, it’s extra critical to get your money in order. It’s also crucial to avoid financial planning mistakes that could be detrimental to your long-term goals.

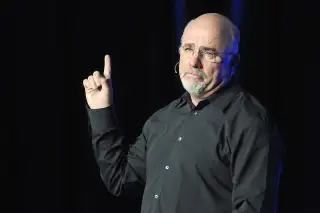

Popular personal finance guru Dave Ramsey, known for his aversion to debt and focus on budgeting, has offered a lot of advice over the years on how to set yourself up for success once you’re in your 50s. Here are three mistakes he says to avoid when you’re planning to retire.

Must Read

1. Retiring with debt

Ramsey emphasizes that leaving your career while you still have debt could be a big mistake. He suggests paying off your mortgage, car loans, credit cards and other types of debt before retiring. While a nest egg may make debt feel manageable, a medical bill or another surprise expense could put you in a position where you become late on your debt payments.

Ramsey recommends attacking debt with intensity before stepping into retirement. That way, you also have time to let your money accumulate before retiring. Those extra few years of asset gains can give you more flexibility when you retire so you don't have to feel strapped and can spend on what you enjoy.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

2. Living without a budget

Creating and maintaining a budget isn’t just a solid financial move for people who are thinking about retirement. It can help you keep your spending in line with your expenses and goals no matter your age — and doing that can help ensure you save enough for retirement.

People who don’t budget can end up overspending on housing, cars and more. Some people buy larger homes than they can afford or opt for a luxury car when a used vehicle makes more sense for their long-term financial goals.

Ramsey views budgeting as "permission to spend" rather than a punishment. Once you take care of key expenses, make debt payments and invest some of your money, the remaining cash can go toward guilt-free spending.

Pet Protection: See How Spot Pet Insurance Can Help Your Dog or Cat

3. Overestimating Social Security

Social Security is a retirement safety net, but it won't necessarily offer enough money to cover all your expenses. Some people underestimate their monthly costs and quickly find that Social Security isn’t enough to cover their essentials. And remember that taking Social Security as soon as you’re allowed to can reduce your benefits compared to prolonging your payments, which increases your payment amounts.

Ramsey advises savers not to solely rely on Social Security for their retirement years. As costs of living rise — and health care costs in particular balloon — it’s important to build a nest egg that can help cover your living expenses and retirement goals, like traveling. That way, Social Security provides additional funds as opposed to being the cornerstone of funding your lifestyle.

Aspiring retirees shouldn't just focus on when they can retire. They should also consider how they can retire, and calculate just how much money they’ll need as costs increase.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account