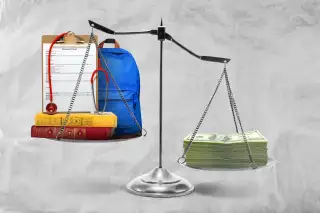

Why Medical Students Graduate With So Much Debt

Choosing to become a doctor is no easy path. Medical school is long, hard, and expensive. The median cost of a medical degree at public schools is nearly $260,000, and private schools can cost even more.

As a result, the average med school student graduates with $200,000 worth of student loan debt, according to the Association of American Medical Colleges.

Of course, if you make it through your board exam and residency, you’ve got solid job prospects to help you pay down all that debt. In fact, the Association of American Medical Colleges (AAMC) predicts that the demand for physicians will grow faster than the supply of new doctors by 2033 — though this year, applications to medical schools have soared.

Still, taking on the financial burden of medical school isn’t something you should do blindly. Here’s what to know about medical school costs and student debt.

How Much Medical School Costs

Most graduate programs are expensive, but medical school ranks among the priciest. Training a doctor doesn’t come cheap, says Julie Fresne, senior director for student financial and career advising services at the AAMC.

“Medical training requires a great deal of resources that are high tech,” says Fresne. "Medical schools need affiliation agreements with local hospitals, so medical students can get job training. Schools need to be able to provide a learning environment that includes a tremendous amount of lab requirements involving cadavers and other expensive equipment,” she adds.

Besides that, medical students also need a special type of health insurance coverage that’s pricier because it protects them against liabilities. These factors combined are what makes medical school’s sticker price so high.

So, how much exactly does it cost to attend medical school this year? Here’s the average cost of health insurance, tuition, and fees by type of institution and residency status, as reported by the AAMC:

- Resident students at public schools: $41,438

- Nonresident students at public schools: $58,246

- Resident students at private schools: $61,490

- Nonresident students at private schools: $57,619

Altogether, the median 4-year cost for resident students at public medical schools is $259,347, while the median 4-year cost of attendance at private schools is $346,955.

How Much You’ll Need to Borrow

With such high prices, it’s extremely difficult to graduate medical school without debt.

This year alone, the AAMC reported that 73% of medical students graduated with student loan debt. How much you’ll have to borrow, however, will depend on a few things, including the type of institution you choose to attend.

Medical students at public schools graduate with a median debt of $200,000 vs $220,000, which is the median debt of those attending private schools.

There are also certain specialties where students graduate with less debt than others, according to a 2017 study that examined medical debt across specializations. These specialties include dermatology, internal medicine, pediatrics, radiation oncology, plastic surgery, and urology. Students pursuing any of these graduated with an average debt ranging from $160,000 to $177,000. Still, it should be noted that this may be tied to the students' economic backgrounds rather than to the specializations themselves.

Types of Loans You Can Get

There are three types of loans you can apply for to help cover the costs of medical school: federal loans, institutional loans, and private loans.

When borrowing for school, your first option should always be federal loans because they offer lower fixed rates than private loans, plus more flexible repayment options. Medical students are eligible for two types of federal loans: Direct Unsubsidized loans and Grad PLUS loans.

Direct Unsubsidized loans have a yearly limit of $20,500 for medical students. You don’t need to pass a credit check to be eligible, you just need to be enrolled in school at least half-time and be in good academic standing. Direct Unsubsidized loans currently have a fixed interest rate of 4.30%.

Grad PLUS loans can be taken out for the full cost of attendance and currently have a fixed interest rate of 5.30%. However, these do require you to pass a simple credit check to be approved for the loan. Both Direct Unsubsidized and Grad PLUS loans require you to fill out the Free Application for Federal Student Aid (FAFSA). And in both cases, you’re not required to start making payments until six months after you graduate.

Institutional loans are loans provided by the schools to help bridge the financial gap that’s left when scholarships, grants, and federal student aid isn’t enough to cover all the costs of attendance. Requirements, borrowing amounts, and conditions vary from one school to the next, but interest rates are usually lower than those of private loans, and repayment is more flexible. For example, Brown University offers institutional loans for medical students with a 7% fixed interest rate that’s subsidized while they’re still in school and for up to three years of their residency.

Lastly, if all else fails, there’s also private loans. These can have fixed or variable interest rates that can be as low as 1.25% or as high as 15%. However, to qualify and secure the lowest rates, you must have a steady source of income and excellent credit or have a co-signer that meets these criteria.

Tips to Minimize Debt

It may be inevitable to take on debt to go through medical school, but there are still ways to reduce the amount you borrow.

Petros Minasi, senior director of pre-health programs at Kaplan, a company that offers test preparation services for college students, says it starts with the application process. Minasi says that the average pre-med student can spend $3,000 or more just applying to medical schools. For some students, the borrowing starts there, before they’re even admitted.

One way to reduce your application costs is by applying for the AAMC’s application fee assistance program. This program can not only help you waive the application fees of up to 20 eligible schools but can also reduce the MCAT registration fee from $320 to $130. To apply, you must provide information about your citizenship status, household size and income, among other things. You can find the full list of requirements here.

Besides that, Minasi recommends checking out schools in your state. While you’ll still have to spend money on living expenses, books, and other materials, choosing a program in your state could reduce your tuition costs by thousands of dollars down the line. Still, it should be noted that this type of discount is mostly available at public schools, although there are some exceptions.

Fresne, from the AAMC, always advises applying for scholarships, grants, and other sources of “free money.” Last year, more than 60% of medical students received an average of $20,000 worth of scholarship money, according to the AAMC. If you’re unsure where to find these, you can always contact your school’s financial aid office or visit the AAMC’s websites for scholarships, grants, and fellowships.

Finally, stick to a budget to avoid overborrowing. Fresne says that since loan limits are higher for medical students, there’s always the temptation to borrow more than what you need. This is why she recommends making a budget and trying to live within your means as much as possible while in school, so you can live comfortably once you graduate. “I always say, ‘Live like a student now, so you don’t have to live like a student later,’” says Fresne.

Debt Repayment During Residency and Beyond

Students often wonder what will happen to their student loan debt once they start their residency. Fresne, from the AAMC, says that while they’re not eligible to receive federal student loans once they graduate medical school, they are entitled to mandatory forbearance during their residency years. Some private lenders also allow students to postpone their payments until after they complete their medical training.

Although you’re not required to make any payments during residency, interest will continue to accrue during this time and eventually will become part of the principal balance, increasing the amount you owe. One way to start tackling your federal student loans while keeping your payments manageable is through an income-driven repayment plan.

The average medical resident earns about $52,000, according to PayScale. “Many residents choose the income-driven repayment plans during residency because the payment is based on their income rather than the level of debt,” says Fresne.

The AAMC calculates that a 2019 graduate with $200,000 in student loans would pay between $320 and $370 a month while in residency under an income-driven plan. But once their salary increases, the association estimates payments would jump to more than $1,600 a month, assuming they earn a $200,000 salary.

Additionally, if you choose to do your residency at a government agency, non-profit institution, or another qualifying employer, those residency years will also count toward the Public Service Loan Forgiveness (PSLF) program. If you enter the PSLF program, you only have to pay your federal loans for ten years, and the remaining balance is forgiven. You can find a full list of qualifying institutions by state here.

More from Money:

Should You Keep Paying Your Student Loans Even If They Might Get Forgiven?

Congress Just Made It a Lot Easier to Apply for Financial Aid

The 3 Current Student Loan Forgiveness Proposals: Who Would Qualify?