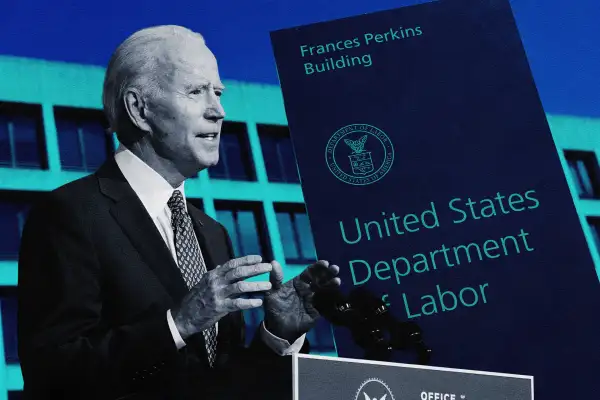

3 Ways Biden's Victory Could Help the Unemployed — Or Those Vulnerable To Job Loss

If you’re out of work — or even fearful of losing your job — the administration of President-Elect Biden could improve your employment (and unemployment) situation, if it’s able to make good on its promises.

That’s the view shared by several non-partisan economic organizations and a researcher on unemployment who have analyzed the unemployment and employment promises of the Biden campaign. The President-Elect’s platform included pledges to restore pandemic-driven federal unemployment supplements and, in the longer term, expand one type of jobless program. The economic analyses also predict his administration’s policies will step up both the number of jobs and overall earnings available to American workers, even if Republicans retain control of the Senate, as is currently the case.

Here are details on the ways in which the 46th president might affect (mostly positively, experts say) employment and unemployment benefits after — and perhaps even before — he takes power.

Renewing emergency unemployment payments

Some Democratic activists have, since the election, complained that Biden did not firmly and frequently enough emphasize the need to extend the unemployment benefits that were part of the CARES Act, and that have now expired. Yet the Biden campaign platform says the president-elect will “work with Congress to extend the boosted unemployment benefits (the extra $600) for however long this crisis lasts.”

Andrew Stettner, Senior Fellow with the Century Institute, says he is also “excited” that the Biden administration also supports continuing unemployment benefits to the self-employed during the pandemic. He notes, however, that “the next step is to adopt a permanent plan to cover this growing part of the economy.”

The fate and timing of these initiatives will depend on successfully passing another coronavirus-driven stimulus bill. Negotiations between Republicans and Democrats on that bill are ongoing, and it’s unclear if and how President Biden might be able to participate in them before he takes office. Either way, Stettner says he expects negotiations between the major parties to be “challenging” in order “to do everything needed to be done on unemployment insurance.”

Adding to the uncertainty of the President-Elect’s success in achieving his goals is whether or not Democrats will gain control of the Senate from Republicans after the special elections in January for two Georgia Senate seats.

,

Increased opportunity to retain at least part of your job

A key proposal of the Biden administration to address unemployment benefits in an ongoing way is a commitment to expand and fully fund job sharing, or what’s formerly known as short-time compensation programs.

These plans allow employers to reduce work obligations (and wages) to employees, rather than outright laying them off, with the affected workers receiving government payments to make up some or all of their lost earnings. To Stettner of the Century Institute, “job sharing is better than regular UI, because employers are able to keep their talent attached to them, making it easier to endure and emerge from hard times. Workers keep their skills sharp by working part time, and maintain benefits and seniority.”

However, here, too, Biden’s proposals will require passage through what could continue to be a Republican-controlled Senate. But Stettner says he is more optimistic about the chance of that support, since short-time compensation programs have already been introduced by both red and blue state administrations.

Biden aims to expand the number of states with job-sharing programs from the current 27 to a full complement of 50 states, plus the District of Columbia, Puerto Rico, and the Virgin Islands. As incentives to those jurisdictions, and to further encourage existing programs, Biden pledges “100% federal financing” for short-time compensation programs.

That pledge should certainly help to expand and stabilize these programs, according to Stettner. “One reason employers do not participate is that they have to pay back benefits through higher taxes. Full federal funding would take away that disincentive to participate.”

More new jobs available

The economic plans of the Biden administration also promise to increase the supply of jobs available to the unemployed, and overall wages, according to two independent economic analyses.

Moody’s Analytics, an economic-research firm, has published an economic forecast that concludes Biden’s proposals would lead to 18.6 million new jobs during his first term, and the average American’s income (after taxes) would increase by $4,800. (By contrast, Moody predicted that the policies of a Trump administration would have led to 7.6 million fewer jobs, and minimal real income gain for average households.)

Both the Moody’s report and another by Oxford Economics acknowledge a strong possibility of a divided government, in which a Republican Senate prevents full implementation of the Biden administration’s economic program. In both cases, the reports say that will dampen the jobs and wage growth over the course of a four-year Biden term, but that these measures would still be positive. Oxford predicts that a Senate-limited program — which the company calls “Biden Lite” — would still yield 2 million new jobs and a 2% rise in disposable income over four years, and that unemployment would drop to 3% over that time.