Should You Keep Paying Your Student Loans Even If They Might Get Forgiven?

Federal student loans have been in automatic forbearance, accruing zero interest for nine months now. During this time, financial advisors have generally advised borrowers who can afford it to keep paying down the principal amount due. But if the free forbearance period is extended once again, does that advice still hold true in light of the possibility of student loan forgiveness?

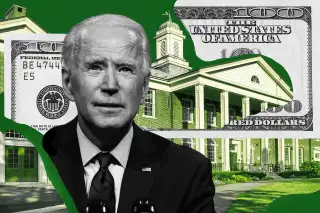

Figuring out the best way to address the country’s ballooning student debt balance has been a divisive issue for a few years, but a recent poll from Vox and Data for Progress found a majority of voters now support forgiving at least some student loan debt. As such, various versions of debt relief have become a mainstay on Democratic party platforms: President-elect Joe Biden campaigned on the issue and has said he supports forgiving $10,000 worth of federal student loans as part of a COVID-19 relief package. Meanwhile, Senators Chuck Schumer and Elizabeth Warren want the incoming president to wipe out $50,000 worth of federally- and privately-held loans via executive order.

For the 42.3 million people with federal student loans, this could be a once-in-a-lifetime opportunity. During normal circumstances, even if universal debt forgiveness was a possibility — as it seems to be now — borrowers would still need to keep making payments until that forgiveness was a certainty, or else they’d risk falling into delinquency and seeing their balances grow as interest accrued. If forgiveness proposals ultimately fell through, then they’d owe even more.

But these are not normal circumstances: Current borrowers have been relieved of their obligation to make payments without facing any penalties. That gives them a period where they can essentially wait and see if forgiveness happens — and if it does, they might be rewarded with a bigger chunk of their debt being wiped out.

So if you’ve been paying down your loans’ principal amount during this time, it might be tempting to stop now and wait for your debt to simply be wiped out. But as usual, your best option really depends on your own unique situation.

“There is no one-size-fits-all with how we advise people with student loans because of how complicated it can get,” says Scott Snider, a certified financial planner and partner at Paragon Wealth Strategies in Jacksonville, Fla.

The average student loan borrower has around $37,500 worth of debt, with 15 million people owing less than $10,000. For those with lower debt burdens, wiping out $10,000 or even $50,000 would eliminate most, if not all, of the money they have left to pay. If your debt is close to or lower than average, then taking advantage of the current free forbearance period and crossing your fingers in the hopes that you’ll be alleviated of at least some debt is probably not so risky, experts say.

“It’s not costing you anything to wait. Until it starts costing you money, I would wait to see what happens,” says Snider.

But not everyone carries an “average” amount of student debt. Millions of federal borrowers, especially those who attended graduate school for professional degrees like medicine and law, have student loan burdens in the six-figure range. If you’re in that boat, cancelling $10,000 or even $50,000 is still going to leave you with years of repayment. Under these circumstances, Snider says your best plan is to continue paying off as much as you can while the zero-interest period lasts: “I would make as much headway as you can right now.”

There are still a lot of details we don’t yet know about widespread loan forgiveness, including whether or not it would cover private student loans. But the current forbearance period has not applied to private loans, which make up 7.9% of all outstanding student loan debt, meaning they’re still accruing interest. So even if you’re feeling extra-optimistic about the possibility of widespread student debt relief, it’s important to keep paying as you normally would if they’re private loans.

Finally, before making any changes to your current plan for paying off student debt, you need to make an honest assessment of your situation. For some it might be wisest to take advantage of the continued penalty-free forbearance period by putting that part of your income toward an emergency fund, while others will want to pay down as much principal as possible while paying zero interest. Ultimately, we won’t know whether or not widespread forgiveness is coming down the pipeline until it actually happens.

“If borrowers get $10,000 or even $50,000 wiped out, that’s great," Snider says. "But until then, we’re proceeding as we have been.”

More from Money:

New Stimulus Bill: Unemployment Benefits Are Getting a $300 Boost

Expert Predictions for 2021 Real Estate Trends

Public Service Loan Forgiveness: 3 Recent Changes That Make It Easier for Borrowers