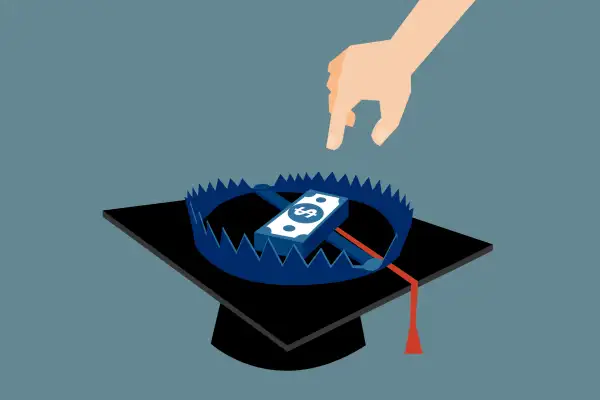

Student Loan Scams Are on the Rise Amid Confusion Over Debt Relief. Here's What to Watch for

Looking for some relief from your student debt burden before federal payments resume in 2022? Make sure to do your due diligence, or you may wind up on the receiving end of a student loan scam.

Consumer protection agencies in multiple states have warned residents in recent months to be on the lookout amid rising reports of student loan scams. With daily news headlines focusing on the status and future of federal student loans — including recent announcements that hundreds of thousands of borrowers will have their debts wiped out — don't feel alone if you're confused as to whether what you're hearing when you're offered help with your loans is legitimate.

Back in August, the U.S. Department of Education announced that more than 323,000 borrowers were eligible for loan forgiveness through the total and permanent disability (TPD) discharge. With the help of data matching from the Social Security Administration, those borrowers are receiving $5.8 billion in automatic student loan discharges.

Additionally, the Biden Administration has upheld a campaign promise of simplifying and streamlining the Public Student Loan Forgiveness (PSLF) program — at least, temporarily. In October, the Education Department announced changes to help more than 550,000 borrowers working in the public sector automatically qualify for forgiveness more quickly by expanding what counts as an eligible payment.

Most recently, White House Press Secretary Jen Psaki confirmed last week that federal student loan repayments, which have been paused since March 2020, will resume in February. As the end of the pandemic-era forbearance period nears, millions of borrowers may be hearing from their student loan servicers for the first time in many months.

Add in a plethora of (so far) unfulfilled promises from politicians regarding widespread student loan forgiveness, and there’s bound to be heightened levels of confusion and panic among borrowers. That creates “a perfect storm” for student loan scammers to strike, according to Walter Suskind, deputy communications director for the Student Borrower Protection Center.

In 2021 alone, the Federal Trade Commission sent out millions of dollars in refunds to victims of student debt-related scams. But that’s just a drop in the bucket compared to the estimated $95 million that fraud victims paid as of 2017 to a group of student loan-related scam operations.

With all of the current disorganization, experts expect heightened levels of student loan fraud heading into 2022 as well.

“Whenever there is a lot of student loan-related news and activity, scammers will leverage that news to try and rip people off,” Suskind says.

Luckily, student loan scams can be avoided — if you know what to look for. Here are three warning signs to look out for, as well as some essential ways to keep your information protected:

1. They want your student loan login credentials… and your Social Security number

One of the main reasons it’s getting harder to know whether something is a scam is because sophisticated phishing operations aren’t actually asking people for lump sums of money any more. Instead, they gather data that can help them set up falsified documents and defraud you for years to come.

“It will seem very legitimate,” says Todd Spodek, an attorney and managing partner of Spodek Law Group based in New York and Los Angeles. “But then they’ll say they need your personal identifiable information.”

Personal identifiable information (aka PII), according to Spodek, includes items like your driver's license, Social Security number, credit card numbers, banking information, and even your Federal Student Aid (FSA) ID. Essentially, PII is anything that can help to prove a person’s identity — or allow a scammer to fake someone’s identity.

“Once they have a full snapshot of your whole financial picture, they can use it to perpetuate a larger fraud,” Spodek says.

2. They ask for payment upfront

It is illegal for a student debt relief company to charge you any fees in advance of a settlement or before providing a service. While some unique situations may call for legal services or private financial counseling, you are still not required to pay anyone for student debt-related assistance until the work is done. If anyone is asking you to pay a fee before even starting the process, this is probably not a legitimate provider.

Additionally, while it is perfectly legal to pay for help managing your repayment, just as you would with other types of financial advice, you don't ever need to pay to access federal programs. Borrowers can fill out all of the paperwork required when applying for an income-based or federal consolidation plan for free on their own. Even if you want to skip the hassle, there are plenty of organizations that can provide borrowers with free assistance. Suskind recommends borrowers use the National Consumer Law Center’s state-by-state list of free legal resources specifically for student loan borrowers.

3. They advertise their services on social media or called you directly

Say you’re in serious financial trouble and looking for student debt relief, so you use Google to search for ‘student loan consolidation'. If you come across websites purporting to get you a consolidated loan with a substantially lower interest rate in exchange for a one-time fee, “that’s a red flag,” Spodek says. “Nobody should be advertising for consolidating student loans.”

Tech-savvy scammers will use digital advertising tools like Google AdWords and disguise themselves as legitimate websites that offer to take care of the work that’s required to be approved for consolidation in exchange for an upfront fee. Or the websites will make big promises about speedy forgiveness or ultra-low interest rates. While some refinancing options and debt counseling companies do advertise their services to borrowers, legitimate federal consolidation and repayment plan options are always available for free.

Additionally, if you start getting hounded with phone calls after reaching out to a seemingly legitimate student loan relief company, or just by simply searching for key terms in Google, it’s probably not a good idea to take them up on the offer. As Suskind notes: “The federal government uses email and postal mail to contact borrowers.”

How to protect yourself from student loan scammers

First and foremost, if you’re in a tight financial situation, the first (and typically only) place you need to look is your student loan servicer. For federal student loan borrowers, these are the companies assigned by the Departmet of Education to handle debt repayment, like Nelnet or FedLoan. They can help you defer your payments, or ideally, set up a lower monthly payment based on how much you’re earning.

“Borrowers have the right to income-based repayment plans,” Suskind says. “If you need help with affordable repayments, reach out to your servicer and ask for help.”

For borrowers expecting a total and permanent disability discharge or who are in the process of having their student loans forgiven through PSLF, it is especially important to double-check with your servicer that the information you’ve received is legitimate.

“If a borrower hears about a way to lower their monthly loan payments or to get their debt forgiven, they should verify this information with the federal government,” Suskind says.

Additionally, another important way to protect yourself is to take the time to research and think through all of your potential options. Student loan forgiveness, consolidation and refinancing do not work the same way as a retailer’s one-day-only 50% off sale; you’re not going to lose out on a ‘good deal’ just because you took a few days to confirm that what you’re being offered is legitimate.

“Anytime anyone is asking you for personal information, you should immediately have reason to pause and say, ‘Look, before I give you anything, I'm gonna do a little due diligence,’” Spodek says.

If you think you’ve come across a student loan scam, or may have already been victimized, be sure to report it to the FTC, as well as your state’s attorney general.

More from Money:

More Colleges Are Promising to Help Pay the Student Loans of Low-Earning Graduates

Watch Out: 2021 Could Be the Worst Year Ever for Gift Card Scams