Emerging Markets Have Struggled All Year. Here’s One Country Bucking the Trend

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

With emerging markets down for the year, including nearly 10% over the past three months, it’s hard to find a bright spot.

Yet, financial experts see a potential bloom in the Brazilian economy -- where the market has been rallying as others fall -- due to the upcoming presidential election on Sunday.

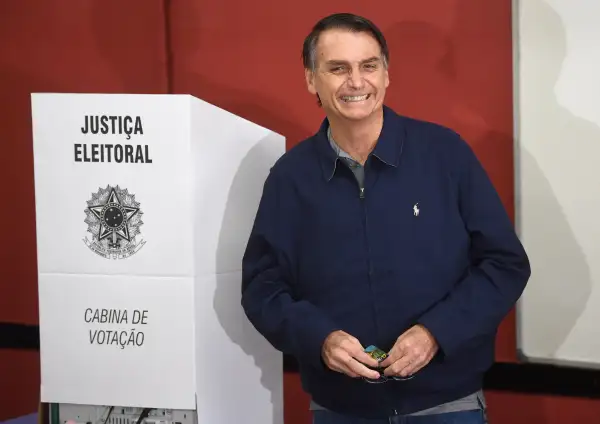

In early October, the first round of Brazil's elections were held and a far-right candidate, Jair Bolsonaro, took a commanding lead, earning 46% of the votes. In the runoff election, he faces the next closest competitor, former Sao Paulo mayor Fernando Haddad who gained 29% in the initial tally. Haddad, a member of the Workers Party, the long-time leading political organization in the country, has faced significant backlash due to corruption from his predecessors.

This leaves Bolsonaro, someone who has advocated privatizing some public entities and ushering in pension reform, the favorite heading into the runoff.

So far, investors like what they see.

Jair Bolsonaro often compared to Donald Trump

The far-right candidate, whose unlikely rise has been likened to President Donald Trump's in the U.S., has campaigned on anti-corruption and cracking down on crime, while also espousing racist, anti-gay and misogynistic views.

His economic strategy, however, has largely been left in the hands of advisor Paulo Guedes, since Bolsonaro has admitted he knows very little about economics. Guedes, on the other hand, is an economist trained at the University of Chicago and has become a favorite among those that track Brazilian stocks due to the plans he has floated.

Guedes argues that Brazil needs to privatize some of its state-controlled companies and take efforts to reform the country’s pension system, which allows workers to retire at 55 and earn 70% of their final salary for as long as they live. Bolsonaro has stated this privatization effort won’t impact the state run oil company Petrobras.

Still, the simple fact that Guedes is someone investors trust – and the expected financial head of the government if Bolsonaro wins – was enough to push up the entire Brazilian market by 5% after the initial vote. In all, Brazilian stocks are down slightly on the year, after factoring in dividends. But that's compared to a decline of more than 15% for emerging markets stocks broadly.

Brazilian stocks vs. emerging markets overall

Some of those post-election stock gains, however, were shed in the days that followed after it was reported that Guedes was under investigation for fraud. Investigators claim that while Guedes managed funds within the public pension, he invested heavily in a company where he’s the controlling shareholder. The report also concludes he also paid out millions in speaking fees to unnamed parties with the funds.

Guedes has denied any wrongdoing.

But this has put Bolsonaro in a bind, since he’s running on platform fighting the same type of corruption that Guedes is being investigated for. Bolsonaro’s loyalty to Guedes has not budged since the news hit.

Emerging markets and your investment portfolio

Where you would likely see the impact from this election is in your emerging market section of your portfolio, if you own an index fund that tracks the growing economies.

Don’t rush out to buy Brazilian names just because of the election; prior to the recent run, Brazil’s market has struggled under a deep recession. And there’s no guarantee that just because Bolsonaro is elected that pension reform will take shape or that it will lead to significant long-term gains for the economy.

But don’t be surprised come Monday if the market jumps on the election news unless, that is, Haddad wins.