8 Ways to Stop Student Loans From Ruining Your Life

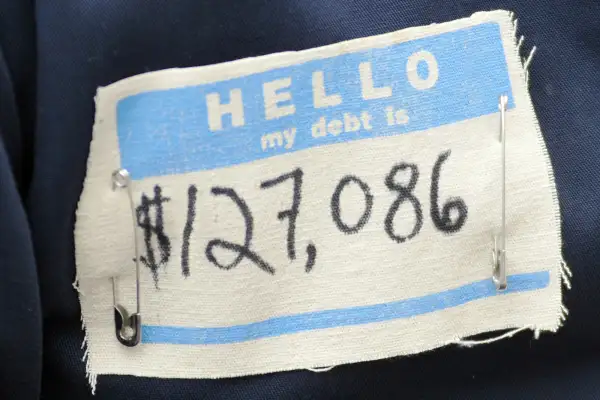

As tuition and student debt have soared, so has the number of college graduates struggling financially under the weight of hefty school loans. About one in four borrowers is at least a month behind on their federal student-loan payments, the Department of Education reported this summer, and the number of defaulters has jumped by more than 500,000 in the past year, bringing the total number of student loans gone bad to about 7 million. And that's not even counting the many more borrowers who keep up with their payments but find themselves stretched to make rent, buy groceries, pay everyday bills, or start saving for the future.

The ray of hope in this black cloud: A growing number of government programs and private start-ups are offering new tools and services to help student borrowers avoid borrowing too much, get out from under onerous monthly payments, or dig their way out if they're in financial trouble.

Here's what you need to know to get your student loans under control, no matter where you are in the borrowing process:

If you’re currently a student—or will be soon:

• Look for colleges that help you rely less on loans. Uncle Sam is making it easier for students to identify and avoid colleges that tend to overload students with debt. The Department of Education is cracking down on colleges with high default rates—an indication that students there routinely have to take on more debt than they can afford. Schools where 40% of borrowers stop making loan payments over a three-year period, for instance, will no longer be eligible for federal loans to students. In addition, the agency is posting each college’s default rate online. Favor schools with low three-year default rates: "At four-year schools, 5% is pretty reasonable," while anything above 10% should be considered a danger sign, says Ben Miller, a former DOE official who is now a senior education policy analyst for the New America Foundation. You can also check out Money's list of The 100 Best Private Colleges If You Need Student Loans, which identifies the schools with the best records of manageable debt loads, and the 25 Most Affordable Colleges. Keep in mind, however, that all default rates and debt stats are averages, and may not reflect the personalized financial aid package you get from an individual school.

• Know your limit. Don't borrow more to get your degree than the salary you can reasonably expect to make in your first year out of school, recommends Mark Schneider, president of College Measures and the adviser to Money’s Best Colleges rankings. (Money’s Best Colleges rankings include estimates of student debt loads at graduation for all 665 colleges on the list.) If you stick with that rule of thumb, your payments will likely amount to no more than 11% of your gross income, which is usually considered a manageable amount, Schneider says. The key is to be realistic about your first-year salary, which is sometimes tough given that stats on how much recent college grads make are spotty beyond broad averages. CollegeMeasures.org offers the only data that breaks down first-year earnings by major, and they only have the figures for six states. To get a ballpark estimate, pick a state and school that seem similar to yours and search for the first-year earnings for your anticipated major. The Money rankings also include early career earnings data from Payscale.com, but the average annual salaries listed are for the first five years after graduation, not year one.

If you’re paying off students loans now—or will be soon:

• Pick the repayment plan that suits your needs. Federal student loan programs automatically enroll all borrowers in a standard 10-year repayment plan, with first payments due six months after graduation. That's next month for many borrowers who got their degrees in May. But the government offers six other repayment options that may result in lower payments now or allow you to delay paying altogether. The Education Department has created a simple tool that will help you figure out your best choice.The new income-driven plans are generally the most attractive because they adjust monthly bills to your salary and offer the possibility that the loan may be forgiven before you've totally paid it off, says Lauren Asher, president of the Institute for College Access and Success. Under these plans, if you work in a government, nonprofit, or other public service job and pay on time every month for 10 years, you can have the remainder of your debt forgiven, without paying taxes on the balance. Other student borrowers who elect income-based repayment may be eligible to have their loans forgiven in 20 or 25 years, depending on when you borrowed, but you will owes taxed on the outstanding amount.

• Put payments on automatic. Most lenders cut rates or offer other bonuses if you agree to have payments automatically deducted from your bank account every month. The federal government cuts your rate by one-quarter of a percentage point, which amounts to about $500 if you pay a $30,000 debt over 10 years.

• Reduce your principal. Got a little extra cash you want to use to pay down your student debt faster? Make sure it goes toward lowering the original amount you borrowed. The Consumer Financial Protection Bureau says it has received many complaints from borrowers alleging that their lenders applied extra payments to their next month’s bill instead of reducing the principal. Since it’s financially advantageous to pay down your highest-interest debt first, that can be a costly misstep. To make sure there is no confusion, the CFPB suggests borrowers send a letter to their lender with specific instructions about how to credit extra payments. Here’s their sample letter.

• Reduce your rate. If you have a steady job and your monthly paychecks total at least $1,000 more than your total monthly debt, there’s a good chance you can refinance a high-interest student loan into a lower rate one that will lower your monthly costs and allow you to pay off your debt sooner. “The refinance market is heating up,” says Bill Hubert of Overture Marketplace, a loan shopping website. Refinancing a high-rate private loan into a lower-rate private one is a no-brainer. But a growing number of banks and start-ups are offering to refinance federal student loans, some of which have annual rates as high as 7.9%, into loans with rates as low as 3.6%. Weigh that decision carefully. Switching from a standard $30,000 federal Stafford loan at 6.8% to, say, a 4% private loan would cut your payments by about $40 a month, and slash the total interest you'd shell out over five years by about $5,000. But you’d lose other benefits like the guaranteed ability to switch to other payment plans and potential forgiveness of your loan.

If you're having serious trouble making your loan payments:

• Act quickly: Although it is human nature to ignore unpleasant confrontations such as those with bill collectors, there’s a big financial payoff to calling your lender as soon as you start missing payments. As long as you haven’t missed more than eight consecutive monthly payments on a federal student loan, you can switch to a more attractive payment plan and get back on track without having to pay any extra collection fees or penalties, says Jason Deslisle, a debt expert at the New America Foundation.

• If all else fails, try bankruptcy. Bankruptcy should be a last resort, in part because it remains on your credit record for seven years. What's more, any relief might be indirect. The laws governing student loans make it very difficult for bankruptcy judges to free borrowers from their student loan debt. But there are two small bits of good news for those in desperate straits: A recent study by a Princeton graduate student found that bankruptcy courts reduced or eliminated student loans for almost 40% of those who asked. Jason Iuliano found that thousands more borrowers would likely also have gotten relief, if only they had asked. What’s more, many borrowers could get relief without having to hire an attorney. Iuliano found that borrowers who represented themselves were just as successful at getting relief as those who hired attorneys.Even if you aren't able to get relief from your student loans, the bankruptcy court will likely reduce or eliminate some of your other debts—such as credit card obligations—thus freeing up money you can use to pay off your student loans.