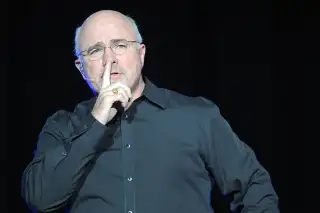

Dave Ramsey’s Tough-Love Advice for Anyone Over Age 50 and Still in Debt

Being in debt can feel stressful at any point in your life — but it can be especially anxiety-inducing when you’re nearing retirement age. While it may be close to time for Social Security to kick in, your investment portfolio has a shorter time horizon to recover from market downturns, and debt payments can take a bite out of your wallet at a time when you're preparing to no longer receive a paycheck.

Popular personal finance guru Dave Ramsey has offered tons of guidance to people in their 50s and 60s who are still in debt but are dreaming of retirement, but his main message is clear: It’s time to aggressively pay off your debt.

Must Read

Dave Ramsey’s core message on debt

Ramsey’s tough-love advice is that carrying debt into retirement could significantly harm your finances in your golden years — and that you need to pay off debt before you retire.

Ideally, if you create and stick to a plan, you can pay off your debt before you retire. Ramsey advocates for catching up as soon as possible, which may require sacrifices, such as working a side hustle or aggressively cutting your expenses.

And while it can be tempting to retire even before your debt is paid off, it may make sense to keep your job a few years longer than you initially planned or maintain part-time work so you can continue throwing money at your debt payments without sacrificing your essentials.

Of course, the best strategy for one person to tackle their debt will look different from what makes sense for another. If you’re unsure about the best path forward, speak to a financial advisor who can help you take your financial situation, goals and timeline into consideration.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

How to pay off debt

If you are juggling multiple balances, you can choose a popular debt payment strategy. The snowball method involves tackling your smallest balance first, then moving on to your second-smallest balance, your third balance and so on. Accumulating small wins can help fuel your motivation.

The debt avalanche method involves focusing on high-interest debt first, then moving on to the balance with the second-highest interest debt and continuing until you’ve paid off all your debt. This approach may help get you out of debt faster, and you’ll save more money on interest than if you opt for the snowball strategy.

Keep in mind that whichever method you choose, you still have to make the minimum payments for all of your debt, such as mortgages, car loans and credit cards.

Pet Protection: See How Spot Pet Insurance Can Help Your Dog or Cat

Adjusting your lifestyle

Getting out of debt in your 50s may require significant lifestyle changes — and skipping your daily coffee run probably won't do the trick. The real savings come if you target your biggest expenses, such as housing and transportation. Switching from a new car to a used vehicle and downsizing your home can free up a lot of space in your budget.

You may also have to set boundaries on how you use money. Dining out less, canceling streaming and other service memberships, and going on fewer vacations may be necessary to dig yourself out of debt. The more expenses you cut, the easier it is to keep your debt under control and pay it off over time.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account