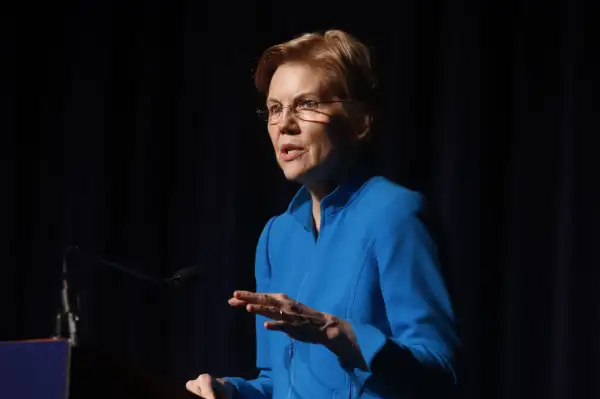

Elizabeth Warren Called for a Wealth Tax on 'Ultra-Rich' Americans. Here's How It Would Work

Elizabeth Warren has proposed a wealth tax on the richest Americans. But what exactly does that mean?

The Democratic Senator from Massachusetts, who recently threw herself into the ring of contenders for the presidential nomination to go against President Donald Trump in 2020, announced her ambition in tweets on Thursday.

“The rich & powerful run Washington… they don't pay taxes on that accumulated wealth. It’s a system that’s rigged for the top if I ever saw one,” she said. “We need structural change. That’s why I’m proposing something brand new – an annual tax on the wealth of the richest Americans.”

Who would pay

She added that she’s calling it the “Ultra-Millionaire Tax,” and it would only apply to those with a net worth of over $50 million, or the “tippy top 0.1%.” That means those Americans holding assets—such as real estate, stocks and bonds or even businesses they founded, depending on the particulars of the possible law—in excess of that amount could be subject to the tax. This is distinct from taxes on income.

Warren has long been focused on broad financial reform in her political career. But the congresswoman, who’s a major contender in polls for potential 2020 Democratic presidential candidates, isn’t actually suggesting something entirely brand new. The yearly tax for the “ultra-rich,” as she has also described her proposal, would certainly be a first for the United States. But wealth taxes have existed around the world, and the concept has been floating around in economic circles for some time.

Economists behind the idea

In fact, the French economist and author Thomas Piketty made wealth taxes something of a hot topic by endorsing them in his best-selling 2013 book Capital in the Twenty-First Century. He sees wealth taxes, as opposed to consumption taxes, as the ideal solution for a number of countries facing growing wealth disparity, believing that overall wealth is easier to define.

That thinking has evidently trickled down into Warren’s “ultra-rich” tax. The Washington Post reported that left-leaning economists Emmanuel Saez and Gabriel Zucman, at the University of California, Berkeley, advised Warren on a potential 2% wealth tax. They also discussed a 3% wealth tax on those who have more than $1 billion, according to Saez. He estimated that the levy would raise $2.75 trillion over a 10-year period from about 75,000 families—less than 0.1% of U.S. households.

Not unlike Piketty, Saez and Zucman see a wealth tax as an avenue to confront the concentration of wealth among the richest. “This is a very interesting development with deep root causes: the fact that inequality has been increasing so much, particularly in wealth, and the feeling that our current tax system doesn’t do a very good job taxing the very richest people,” Saez told The Washington Post.

Channeling AOC

Saez has a kindred spirit in Democratic Representative Alexandria Ocasio-Cortez of New York, who has proposed raising the top marginal tax rate hike to 70% for income (as opposed to assets under a wealth tax) above $10 million. Saez and Zucman praised the plan, saying it would alleviate an “inequality crisis.” Ocasio-Cortez, a quickly rising star in the Democratic Party, has come under scrutiny, including from billionaire Michael Dell, who said he was against the notion.

Warren’s wealth tax could face legal hurtles, even if it proves popular with voters. Analysts including at The National Review and Mother Jones have called into question whether her proposal is even constitutional. The US Constitution forbids direct taxes of this sort unless they’re apportioned to each state by population, which could make it unworkable in practical terms.

Of course, a constitutional amendment is an option, however unlikely. For now, Warren’s proposed wealth tax appears to be primarily a campaign statement. And it’s certainly gotten people talking.