How to Get Your Paycheck Faster with Early Direct Deposit

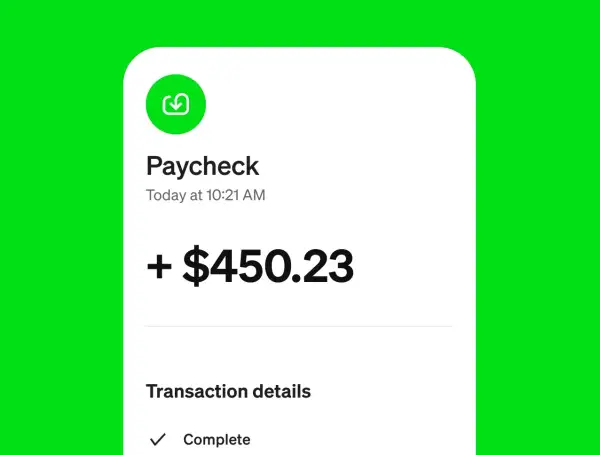

Waiting for payday can feel like a balancing act. Your bills are due, your fridge is low, and you're stressed to the max out about making it to your next paycheck. But what if your paycheck didn’t have to take the scenic route to your bank account? When you set up direct deposit through Cash App — which lets customers fast track their earnings up to two days early through many banks — you can access your money when you need it.

How Early Direct Deposit Works

Here’s a little-known secret: when your employer submits payroll, that money often reaches the bank a day or two before you officially get paid. If you get paid on Friday, for example, traditional banks don’t allow you to access that money until that exact day. With Cash App, if your funds come through direct deposit on Wednesday, you can access them on Wednesday.

How to Set It Up in Cash App

It’s a pretty straightforward process: Open Cash App and tap the Money tab on your home screen, then select Direct Deposit to find your unique routing and account numbers. The app gives you options from here: by searching for your employer and securely logging into your payroll account, or by manually copying your Cash App routing and account numbers and sending them along to your company’s payroll department. After that, you can sit back and enjoy the fruits of your labor — up to two days before your coworkers.

📲 Download Cash App now and skip the banking fees — send, spend and manage your money your way.*

Sponsored by Cash App

Cash App’s Disclosures:

*Cash App is a financial services platform, not a bank. Banking services are provided by Cash Appʼs bank partner(s). Direct deposit provided by Cash App, a Block, Inc. brand. Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Free Cash App Cards come in black and white.