They Fought a Daughter's Heroin Addiction and Their Insurer, at the Same Time

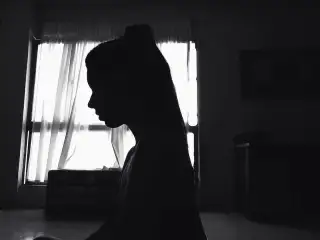

Don and Sally Vail of Stonington, Conn., first learned that their daughter Maddie had an addiction problem when they received an explanation of benefits from their insurer about her stay at a rehab center. At 19, Maddie had checked herself into the facility with the help of a family friend, telling her parents only that she’d be away for a while.

Turns out, Maddie was one of the roughly 27 million Americans who use illicit drugs or misuse prescription drugs, according to the recent U.S. Surgeon General’s report on alcohol, drugs, and health. She started out as one of the fortunate ones: She was among the scant 10% to receive any kind of treatment for misusing alcohol or drugs. While she first sought help on her own, her parents joined the effort as soon as they learned of her problem.

Their two-year struggle ended in tragedy on Jan. 23, 2016, when Maddie died of a heroin overdose at age 21. But it wasn’t before she and her parents put up a fight—against the family’s health insurance carrier, against a society that discriminates against addicts, and against a powerful disease that in 2014 claimed the lives of a record 28,647 Americans who fatally overdosed on some type of opioid, including prescription pain relievers and heroin. To address this staggering toll, lawmakers earmarked $1 billion for states to fight the opioid epidemic over two years in the 21st Century Cures Act, which President Obama signed into law on Dec. 13.

- Read Money's special report: The High Cost of Coping

The Vails’ fight left them emotionally and financially drained. “You love the people in treatment, and you’ll do anything to save them,” says Don.

An Uneasy Feeling

A talented artist and cook, Maddie suffered from dyslexia and hadn’t enrolled in college after graduating from high school. She’d been withdrawn and uncommunicative, spending more time in her childhood room—her parents had let her paint each wall a different color—in the five-bedroom house she shared with her parents and siblings overlooking Little Narragansett Bay.

Her parents, a dentist and a former insurance broker, thought Maddie might be taking marijuana but didn't press the issue for fear of pushing her away. “If you have an uneasy feeling, don’t ignore it,” Don says.

The first facility Maddie visited was inside her insurance plan’s network, and the carrier covered her treatment in full. But that stay proved inadequate when Maddie overdosed on heroin soon after her return. She spent just four hours in the emergency room before being discharged. “She shouldn’t have been tossed to the curb,” says Sally.

The Vails then admitted Maddie to the well-regarded, not-for-profit Caron Center in Wernersville, Pa. The facility asked for $32,000 upfront to cover some of the first month's treatment, a not-uncommon practice since facilities can’t count on getting money from patients’ insurance, experts say. The Vails borrowed that money from a relative.

While Caron Treatment Centers would not comment on this particular case, in a statement president and CEO Doug Tieman said, “At Caron, we work to effectively utilize insurance as much as possible. However, we choose to deliver the highest standard of care to patients and their families instead of sacrificing quality or shortening a treatment plan to accommodate insurance policies.” The organization provided more than $10 million in treatment scholarships to patients during its past fiscal year, according to Tieman.

The Financial Blows

Maddie thrived at Caron. The facility was out-of-network for her health plan, and the total tab came to $34,186 for a 20-day stay. Caron submitted bills to the Vails’ insurer, UnitedHealthcare, in hopes that the family could at least get reimbursed for Maddie’s treatment at the lower, out-of-network rate.

Instead, the claims were denied on the grounds that the Vails did not receive pre-certification for Maddie’s stay, Don says. There had been no time for paperwork: The Vails had rushed Maddie to Caron after her overdose and swift discharge from the hospital.

"We try to assist members in better understanding their coverage options and, if necessary, their appeal rights," a UnitedHealthcare spokeswoman said in a statement. "We sympathize with the Vail family for their terrible loss."

The Vails appealed their insurer’s decision and their claim was denied again, this time based on lack of medical necessity, according to the Vails. Maddie clearly needed help, but she received a type of denial that is relatively common when it comes to mental health claims: 29% of patients reported having a mental health claim denied based on medical necessity, versus 14% of patients for purely medical claims, according to a 2013 survey reported in JAMA Psychiatry.

Congress passed a law in 2008 aimed at preventing insurers from treating mental health claims any differently than purely medical claims. But these types of denials suggest that the playing field remains uneven, and the 21st Century Cures Act contains provisions to boost enforcement of the 2008 mental health parity law.

UnitedHealthcare said the carrier followed "independent evidence-based guidelines" in setting coverage parameters.

Fighting Back—With Help

The Vails decided to fight their denial. Don worked as an insurance broker to small and mid-sized businesses, advising them on health benefit design. But claims are a different specialty, and even he needed help with the appeal. “Not many people are equipped to deal with insurance on that level—we’re out of our depth,” he says.

That fact isn’t lost on insurance companies, which “count on attrition,” he adds. “They count on wearing you down.” It’s too complicated and dispiriting to appeal their denials, Don says, so lots of people give up.

Instead, the Vails hired Katalin Goencz, an insurance appeals advocate at MedBillsAssist in Stamford, Conn. Her efforts over the course of a year caused the Vail’s insurer to ultimately pay most of the Caron bill, Don says. Goencz also helped the Vails recoup about 40% of the cost of Maddie’s subsequent, three-month stay at what's called a step-down facility, which provides less intensive care, according to Don's records. In appealing mental health claims, “you need to address why the patient is there for so long,” Goencz says.

Maddie was there for so long because heroin rewired her brain circuitry Addiction disrupts whole sections of the brain, reducing executive functioning while increasing tolerance to the harmful substance, according to the U.S. Surgeon General’s report. There’s evidence that these changes in the brain persist long after substance use stops.

A Cruel Irony

In the end, Maddie couldn't stop. “She wanted to quit, but it had her by the scruff of the neck,” Don says. She lived for three weeks after her ultimately fatal overdose last January, spending part of that time on life support.

UnitedHealthcare covered all of Maddie’s expensive, end-of-life care, which was more than double her total treatment bill. “The cost of dying was much more expensive than the cost of treatment,” Don says.

The emotional cost of Maddie's struggle cannot be so neatly calculated. Don and Sally included Maddie’s true cause of death in her obituary. Addiction carries an unfair stigma, they wrote. It is clearly an illness, yet society still makes an artificial distinction between physical and mental health. “We are losing the war against drugs,” Don says. “I have enormous empathy for anyone battling this disease.”