How Investors Can Conquer Their Fears When the Market Gets Rocky

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Sometimes the best way to grasp a complex concept is with a simple picture. The videos in "Big Ideas in Simple Sketches" offer illustrated insights from some of the best minds in money. The drawings may look pretty basic, but the thinking behind them will ultimately make you a better investor.

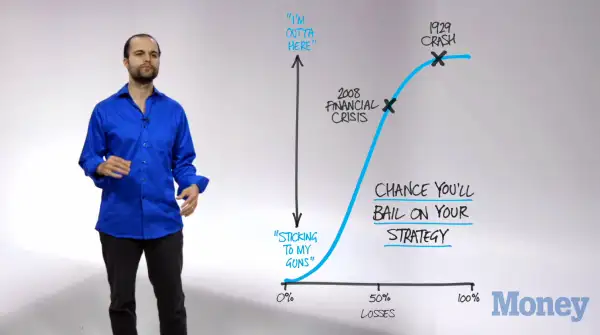

When drawing up a financial plan, advisers will ask you to specify how big of an investment loss you can stomach. But in his book Rational Expectations, William Bernstein of Efficient Frontier Advisors uses a chart like this one to drive home the reality that you probably feel braver in good times than you'll really be when it counts. "Take the decline you think you can tolerate and divide it in half," says Bernstein.

Read next: 12 Great Stocks for 2016

Allowing for your emotional fluctuations matters a lot because if you get spooked into selling your holdings, you may do so at exactly the worst possible moment. Panicked investors who dumped their stocks in March 2009, after the financial crisis pulled shares down 57%, missed out on the market's 240% total return since then.