This Chart Explains Why You Shouldn't Try to Time the Market

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

In 2007, just before the financial crisis, more than 90% of individual investors thought stocks were the best investment, according to survey data collected by Yale's Robert Shiller. By 2011, the number had fallen to just over 70%, the lowest point since the survey started in the 1990s. By then, the economic recovery was well underway and the current bull market had years to run.

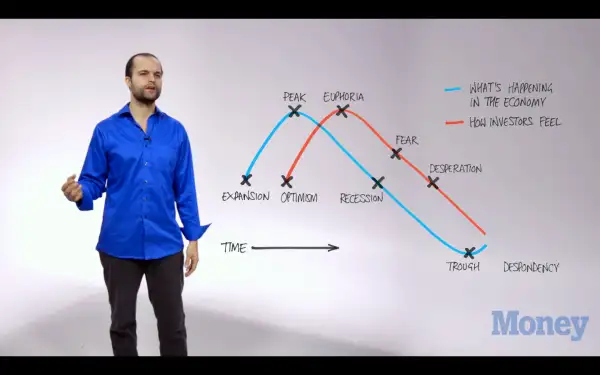

Investment manager Gregg Fisher, founder of Gerstein Fisher, made this slightly tongue-in-cheek model of how slow investor sentiment is to register what's actually happening in the economy.

Read Next: How Investors Can Conquer Their Fears When the Market Gets Rocky

The upshot: If you know that recent market experience is likely to color how you see your investments, you can decide not to try to time the market's twists and turns. Find a strategy that makes sense for you and resolve to stick with it, except for rebalancing your portfolio once a year or so.