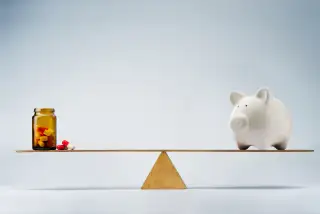

Here's the Tough Choice the Uninsured Have to Make Now

Americans who didn't sign up for health insurance by the February 15 end of open enrollment face two serious risks: no insurance coverage for the rest of 2015, and a possible tax penalty next April. Open enrollment for 2016 plans doesn't start until next October.

What's more, many who went without health insurance last year—when Obamacare's requirement that all Americans have insurance, what's known as the individual mandate, went into effect—are already facing a penalty on their 2014 tax returns.

Many of these uninsured Americans got a break last week. The Obama administration announced a special open enrollment period last Friday. If you still don't have 2015 health coverage, you did not know about the tax penalty until you worked on your tax return, and you owe a penalty for 2014, you can enroll in a 2015 plan via Healthcare.gov between March 15 and April 30. The second chance is available to people who live in the 34 states with a federally-run insurance marketplace and who file their federal taxes after February 15.

This deadline extension could help a lot of people: Late last year, 44% of uninsured Americans said they had heard little to nothing about Obamacare's individual tax penalty, according to a poll by the Urban Institute.

There's a twist, however: To qualify for the extension, you must be subject to the tax penalty, according to the Department of Health and Human Services. But most Americans who are still uninsured could qualify for an exemption from the tax. Take it, and you don't get more time to buy health coverage for this year.

The Choice

There are more than two dozen ways to get out of paying the Obamacare penalty: you earn less than the tax filing threshold, your cheapest plan costs more than 8% of your income, you were uninsured for less than three months, you filed for bankruptcy, or you had some other hardship.

Altogether, the government estimates that only 2% to 4% of taxpayers will owe the fee. Another 10% to 20% are uninsured but are exempt from the penalty. Those taxpayers have two options:

- Pay the tax for 2014 and buy health coverage for 2015 during the special enrollment period, which has the added benefit of getting you out of the penalty next year.

- Claim an exemption from the tax for 2014 and go without health insurance again in 2015 (and potentially face the tax again next year).

"The taxpayer needs to make a choice," says Tara Straw, senior policy analyst at the Center on Budget and Policy Priorities. "It would seem a no-brainer, a week ago, that you would claim an exemption if you were eligible for it. But now, there really should be a discussion about whether it’s better to take the exemption someone is eligible for, or pay a penalty and have a special enrollment period."

The Potential Penalty

The penalty for being uninsured for all of 2014 is either $95 per person in your family (capped at $285), or 1% of your income (capped at the price of the average premiums for a bronze plan), whichever is higher.

H&R Block has found that so far, the average Obamacare penalty for its clients is $172, decreasing the average refund by 5%.

"It’s definitely a significant amount of money for people who might be low-income and might have a lot of plans and expectations for what they might do with the tax refund," Straw says. "But we need to weigh that against the fact that the penalty next year is much higher."

In 2016, the penalty will be either $325 per person in your family (capped at $975), or 2% of your income (capped at the price of the national average premium for a bronze plan in 2015—to be determined), whichever is higher.

The Bottom Line

Are you faced with this choice? Keep in mind that health insurance may be less expensive than you think. If your income is less than 400% of the federal poverty level—$95,400 for a family of four in 2015—you'll likely qualify for a subsidized premium.

HHS found that 87% of the people who bought an Obamacare plan qualified for this tax credit, bring the price of health insurance down to an average of just $82 a month. Use the Kaiser Family Foundation's calculator to get an estimate of your costs.

Also, if your income is less than 133% of the poverty line—$15,654 for a single person in 2015, $32,253 for a family of four—you could qualify for Medicaid. You can sign up for Medicaid any time during the year, Straw says.

"It’s unfortunate that some people might be put in this position, but at the end of the day, if someone can enroll in coverage and avoid paying a penalty for 2015, that’s still a good deal," Straw says.