Online Installment Loans Can Be Convenient. But There Are Cheaper Ways to Borrow

With interest rates low, American consumers are borrowing more than ever. Now lenders have a new pitch: Installment loans.

Recently ads for the loans seem to be everywhere — on the radio, on TV, even following you around the Internet. The sales proposition goes something like this: Want to consolidate debt? Pay off your credit cards? You can get approved the same day to borrow tens of thousands of dollars.

While these loans have been around for years, the latest iteration, which first began at the beginning of the recession around 2008, have since proven popular. Each year nearly 10 million Americans borrow anywhere from $100 to $10,000 and pay more than $10 billion in finance charges, according to a 2018 study from Pew Charitable Trusts. Big name companies like Goldman Sachs and U.S. Bank have rushed to get in on the market.

While these loans can be useful in some situations, weak oversight means lenders often "obscure the true cost of borrowing and put customers at financial risk," concluded the Pew report.

Cost vs Convenience

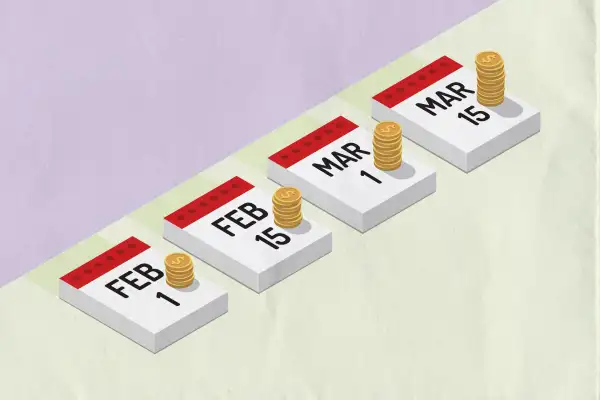

While installment loans can help you retire other types of debt, you pay a price for that convenience. These loans generally carry higher rates than personal loans from banks, credit unions and home equity loans. What's more some charge an initial fee that is paid up front and not wrapped into your loan, as it would be with a mortgage.

Once you do the math on the loan terms, the total debt payments can pile up. For example, through LendingTree, an aggregator of loan companies that compete for your business. According to one test, an applicant with good credit received an APR of 13.49% on a $50,000 loan over three years. The best-case scenario was a loan with a monthly payment of $1,697. The total debt payments came to more than $11,000.

If you own a home, cheaper alternative to a high-interest installment loan for home owners may be your mortgage company. With homebuyers are reaping the benefits of historically low mortgage interest rates, a home equity or a cash-out refinance loan may offer a more competitive rate. By mid-November, for example, home equity loans averaged 5.77%, according to Bankrate.com.

Credit unions are another choice, especially for people with lower credit scores. The rates are typically lower than traditional banks and they are used to working with people on the lower end of the credit spectrum. A credit union will often charge a nominal annual membership fee around $25 but be well worth it in savings over time. The average APR on three-year personal loans from federal credit unions was 9.29%, according to NerdWallet.

Other possibilities for small amounts for those who don’t own homes are credit cards that offer a 0% balance transfer period of 12 to 18 months. These cards often come with a transfer limit of $2,500 and fee of $250 to $500. Outside of the balance transfer period, the APR typically jumps to anywhere from 15% to 27%. Opening a new credit card, however, it could hit your credit score.

You can find our pick for Best Balance Transfer credit cards here.