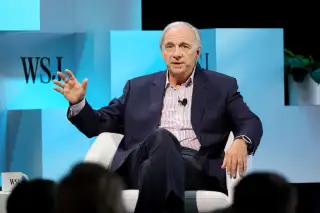

Ray Dalio’s One Rule for Smarter Investing — And Why It Works in Every Market

Bridgewater Associates founder and legendary investor Ray Dalio has navigated many economic cycles while building a multi-billion-dollar portfolio. One of his simple rules to reduce your risk of losses is to diversify your portfolio.

Mastering this rule can lead to steady growth and less volatility in your retirement years. Here’s what you need to know.

Must Read

Ray Dalio’s rule explained

Dalio says that you should not put all of your eggs in one basket. That means not going all-in on a single stock or sector, even if you believe it’s about to take off. The stock market goes through cycles of ups and downs, but it’s impossible to reliably predict every rally and downturn. That means putting all your eggs in one basket can risk you needing to withdraw when the market is down.

Dalio’s systematic diversification helps him spread his capital across sectors and helps him thrive in all environments instead of embracing a boom-or-bust portfolio.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

Why diversification works

When one area of the financial markets like stocks are performing poorly, another asset like gold may be holding steady. The same goes for sectors and sizes of stocks within the stock market: Consumer staples and industrials may hold steady or even outperform when tech stocks are suffering.

Diversification allows you to take advantage of that, ensuring your portfolio is exposed to a variety of assets so that when one area underperforms another area holdings steady or outperforms. Ideally, your entire portfolio doesn’t tank at once.

A diversified portfolio may underperform during economic booms compared to a portfolio focused on growth stocks, but that same portfolio likely won’t drop as much during market corrections.

Free Trade: Check out Robinhood's online trading platform and get the first trade on them

How to diversify your portfolio

To diversify, build exposure to a mix of assets of various types, sizes and sectors. Younger investors with longer time horizons may want to have more stock exposure than older investors nearing retirement who want to take some risk off the table. You also want to make sure you have some cash available so that you’re never forced to sell during a downturn to cover your needs.

Low-cost index funds are one way to easily gain exposure to a broad variety of assets. For instance, an exchange-traded fund (ETF) that tracks the S&P 500 will give you exposure to 500 of the most prominent companies in the U.S.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account

Rebalance regularly — like quarterly or annually — to ensure proper diversification. Rebalancing entails buying and selling assets to get you back to your ideal asset allocation, such as 70% stocks and 30% bonds. Your asset allocation should align with your goals, time horizon and risk tolerance.

Diversification can become even more important for investors who are approaching retirement, since they don’t have as much time to recover from market downturns.