Why California's New Retirement Savings Plan May Become a National Model

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

A new state retirement saving plan has just been launched in California, which could help millions of workers—both in the state and around the country.

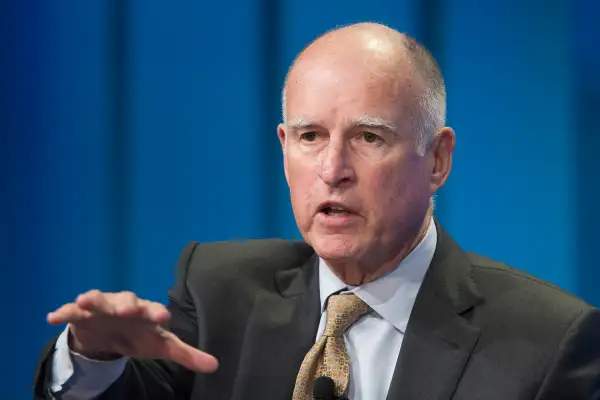

California Gov. Jerry Brown on Thursday will sign a bill that establishes a state retirement savings plan called Secure Choice. The program will provide coverage to some 7.5 million small-business employees in the state who lack workplace plans. The Secure Choice plan will require small employers to auto-enroll workers in an IRA.

The launch of an auto-IRA by California, the largest state, adds major momentum to a burgeoning movement to improve retirement security for workers without 401(k)s or other employer plans. “It’s a game-changer,” says Sarah Mysiewicz Gill, senior legislative representative for AARP. She expects California's launch will encourage more states to develop their own plans.

Already some 30 states are in various stages of setting up auto-IRA programs. California Secure Choice is not likely to start rolling out until 2018, but Washington and Oregon are scheduled to open plans in 2017. Five other states—Connecticut, Illinois, Massachusetts, New Jersey, and Maryland— have enacted legislation to set up savings programs, according to the Georgetown University Center for Retirement Initiatives.

Having access to a workplace plan is crucial to successful retirement savings. Without that nudge from an employer, especially through auto-enrollment, most workers procrastinate and fail to save. Some 90% of workers with employer plans are saving for retirement vs. just 20% of those without one, data from the Employee Benefit Research Institute show.

That’s a big problem, since at any given time, only about half of U.S. private-sector workers participate in a 401(k) or other employer plan, typically those employed at larger companies, according to the Boston College Center for Retirement Research. By contrast, those who work for small business, or freelance or are self-employed typically lack a plan. That group makes up about half the workforce, some 55 million people.

Still, state savings plans alone aren’t likely to solve the looming retirement shortfall. As a 2015 GAO study found, half of all households age 55 and older have no retirement savings. Even those who have 401(k)s are failing to save enough for a comfortable retirement—the median balance is just $26,405, according to Vanguard. For older workers, those ages 55-64, the median balance is $177,805—substantially more, but probably not enough to maintain living standards over two or more decades in retirement.

That’s why many retirement experts, financial services companies, and advocates for seniors are pushing for more retirement plan reforms on the federal level. A national auto-IRA was first proposed back in 2006, and it received strong bipartisan backing. But gridlock in Washington has stalled any progress. Perhaps the state savings plan movement will finally spur action in D.C. That would go a long way toward fixing the retirement crisis.