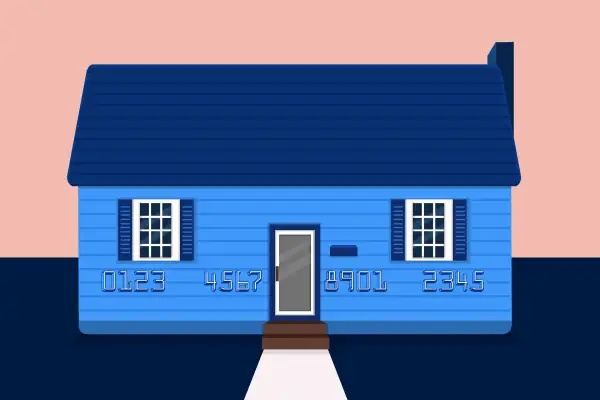

Should You Borrow Against Your Home? Here's What Everyone Should Know

More than a decade after the foreclosure crisis, home equity has recovered to a record high of $15.8 trillion. This pool represents an opportunity, lenders say: homeowners with credit card and other debt can save thousands by refinancing using their own home equity.

The average credit card debt among households that carry a balance — in other words, those that don't pay off their bill in full each month — is $9,333, according to an analysis of Federal Reserve data by ValuePenguin. Meanwhile, a record $6.3 trillion in home equity is considered “tappable,” meaning that homeowners could pull it out and still retain 20% equity. It's important to leave this cushion in case home prices fall; you don't want to end up underwater, owing more than your home is worth.

That's what happened to some homeowners during the Great Recession. They overextended themselves borrowing against their equity, assuming they could live beyond their means because their home's value would always rise. They learned the hard way this wasn't the case when property values fell.

While home prices have since recovered, it's important to do your research before borrowing against your equity.

Unlike a home equity loan, which is disbursed as a lump sum, a home equity line of credit (HELOC) is a loan that you can tap as needed until you reach the maximum allowed amount. You pay only monthly interest during the first years of the loan, then once this so-called draw period ends your monthly payments increase to include the principal.

“What you’re seeing now is smarter underwriting and smarter lenders,” says John Sweeney, head of wealth and asset management for Figure Technologies, a San Francisco-based lender that offers the Figure Home Equity Line. “I think today’s consumers are smarter and educated about how to use debt successfully.”

Consolidate High-Interest Debts

The biggest benefit a HELOC offers over a credit card is an interest rate that might be half or even a third of what your credit card company charges. Because you're using your house as collateral, “they typically have lower payments than most other loans," says Mike Schenk, chief economist at the Credit Union National Association. You can lower the amount you pay to service higher-cost debt, such as credit cards, personal or student loans, by paying it off with a HELOC.

According to a study by Figure Technologies, homeowners are missing the chance to save a collective $100 billion by consolidating higher-interest debt into HELOCs. On an individual basis, this means Americans who have both equity built up in their homes and credit card debt could save just over $6,000, Sweeney says, by consolidating that high-interest debt into a HELOC. “Basically, you’re just using your home as a backstop for that high interest credit card debt,” he says. “It’s a fairly substantial savings.”

Fund Home Renovations

Another big reason people borrow against their homes is to make additions or improvements to their property without having to put the cost on credit cards. If you’re considering a big renovation, Schenk suggests doing some research into your local real estate market before taking out a HELOC.

“I would say these are best used for investments that would increase the value of your house, or the livability of the property,” he advises. In other words, overhauling a kitchen that dates from the Nixon administration might be better than, say, adding a pool with a waterfall and a grotto. Similarly, if you live in a middle-income neighborhood, be cautious with plans to expand your home to McMansion proportions.

For retirees, a HELOC can be a great way to access the necessary capital to undertake the kinds of modifications — wider hallways, accessible bathrooms, and so on — that can facilitate “aging in place.”

Consider the Caveats

These days, it's not hard to take on more debt, Schenk says. That's because lending institutions are eager to continue the growth they enjoyed during the economic recovery. So it’s your responsibility to make sure you can handle your debts, and to have contingency plans in case a job loss or other unforeseen event upends your household finances. “People really do have to be careful with the amount of debt they take on,” Schenk says.

If you're unable to make your HELOC payments, the lender could take your house, Schenk notes. Sound budgeting practices are key to managing your obligations.

“Make sure you have three to six months’ of expenses set aside in a savings account,” he recommends. “Having that rainy day fund set aside is a really good thing.”

Another wrinkle with HELOCs is that, unlike traditional mortgages or home equity loans, they have variable interest rates, meaning they can reset at regular intervals as the benchmark rate changes.

Interest rates have been hovering around historic lows for the entire economic recovery, and experts don’t expect that to change anytime soon. That said, if you’re entering into a deal with a 25-year term (typical for HELOCs), the prospect of rising rates is something you need to factor into your calculations.

“I would ask the lender to tell me how quickly it can go up and what’s the mechanism by which it would go up,” Schenk says. “And ask the lender to construct the worst-case scenario,” he adds, so that you can make sure you’ll be able to make those higher payments.

Figure is a 2019 advertising partner with Money. This article was produced independently and meets Money's editorial standards.