Why Stock Market Losses Feel More Extreme Than Gains

Money is not a client of any investment adviser featured on this page. The information provided on this page is for educational purposes only and is not intended as investment advice. Money does not offer advisory services.

Sometimes the best way to grasp a complex concept is with a simple picture. The videos in “Big Ideas in Simple Sketches” offer illustrated insights from some of the best minds in money. The drawings may look pretty basic, but the thinking behind them will ultimately make you a better investor.

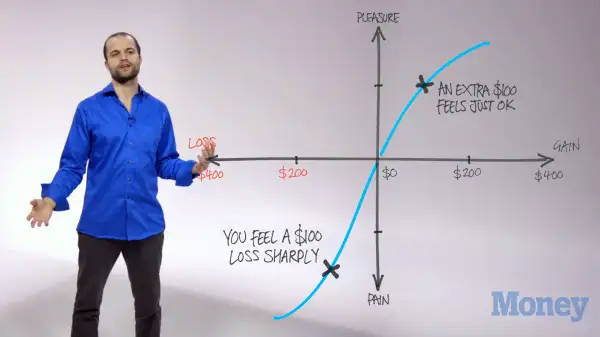

In a 1979 paper, psychologists Daniel Kahneman and Amos Tversky first drew this simple line to illustrate a phenomenon, confirmed by clever experiments, called loss aversion. (Kahneman would later win the Nobel Prize in economics, in part for this insight.) The line's relatively sharp drop toward despair on the losing side shows that pain sets in quickly when we lose. Faster, in fact, than pleasure rises when we win.

Watch next: How Investors Can Conquer Their Fears When the Market Gets Rocky

Behavioral economists say loss aversion helps account for why you may be reluctant to sell and admit to a loss on a poor investment, but eager to take money off the table if you have a winner. It might also be a reason that saving is hard: The pain of "losing" the dollars you put into a 401(k) instead of getting to spend them may outweigh the happiness you expect to feel as the money grows over time.