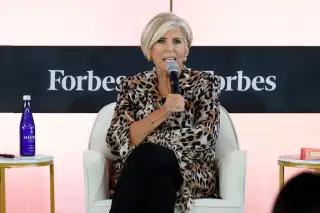

Suze Orman’s Golden Rule of Money: Why Peace of Mind Beats Chasing Bigger Returns

Personal finance guru Suze Orman has offered tough-love financial advice for decades. She has stuck with some of her core themes during this entire stretch, such as avoiding impulse purchases and staying out of debt.

However, more recently Orman has been emphasizing the importance of peace of mind when it comes to your finances. Here’s what she wants you to know.

Must Read

Maintain a cash buffer

Orman is an advocate of emergency funds, or cash funds that will help you handle surprises. Having an adequate emergency fund will make you less stressed about market headlines, knowing that you have enough money to ride the volatility. Financial advisors tend to recommend holding enough cash to cover at least three to six months of your expenses.

For retirees, having money easily accessible is especially important for covering an expense Orman says can be a surprise for people in retirement: health care.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

Don’t let emotions cloud your investing

Orman says that controlling your emotions and not letting them impact your investing strategy is a key part of a strong financial plan. That includes not chasing returns due to the fear of missing out (FOMO).

Some people pursue speculative assets because they feel like they are behind other investors. This sense of FOMO can lead to bad investing decisions. Orman believes investors should have enough money on the sidelines to stay calm during market downturns instead of feeling like they have to take big gambles to reach their goals.

Orman also emphasizes the importance of diversification, or having a mix of assets in your portfolio.

Free Trade: Check out Robinhood's online trading platform and get the first trade on them

As investors approach retirement, they often want to take some risk off the table by lowering their exposure to assets like stocks and getting more exposure to lower-risk assets like bonds. That’s because big losses early in retirement can have a significant impact on the rest of your retirement, and time horizons at this point in life may not be long enough to recover from market downturns. This balanced approach reduces peak returns but also makes it easier to sleep at night. If your entire net worth can swing dramatically after a week of negative headlines, it’s not worth chasing excessive returns. Diversification also minimizes the risk of having to cut back on withdrawals during a stock market correction.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account

Create peace of mind

Orman has said that financial freedom isn’t just about how much money you have, but about peace of mind and not having to worry about "what-ifs." She recommends reviewing your insurance and checking that your beneficiaries are listed on your various accounts to help create peace of mind.

Before making any big money decisions, you should ask yourself if a big purchase will increase or decrease your peace of mind.