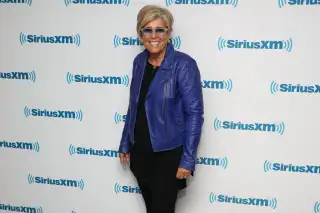

The Suze Orman Rule You Should Probably Break

Personal finance guru Suze Orman has made a career telling people what to do and not to do with their money. She provides advice on how to steer clear of credit card debt, build emergency funds and make smart investments.

However, as is the case with most personal finance rules, not every piece of advice will make sense for every person. One of Orman’s tips — to cut up your credit card if you’re in debt and overspending — is advice many consumers can leave out of their plan. Here's why.

Must Read

Suze Orman’s credit card rule

Orman is an advocate of cutting up your credit cards if you can’t pay them off in full. On her blog, she says, "If you are in credit card trouble, you must cut up all of your credit cards now, with the possible exception of one card for emergencies; do not carry this card in your wallet, however."

The idea behind this strategy is to encourage you to rely on money already in your bank accounts to cover expenses instead of continuing to bury yourself in debt. Credit card debt in particular can hurt your overall financial plan since it comes with high interest rates. If you cut up your card, you can’t use it swipe next time you’re at a cash register.

Gold Investor Kit Offer: Sign up with American Hartford Gold today and get a free investor kit, plus receive up to $20,000 in free silver on qualifying purchases

Why the rule might not make sense for you

If you cut your cards and close your accounts, you miss out on an opportunity to potentially build your credit score, which can result in lower interest rates for mortgages, auto loans and other financial products.

Credit cards also have rewards programs and enhanced consumer protections compared to debit cards. Ditching credit cards completely can mean missing out on rewards, like cash back and airline points that could help you save elsewhere.

To be clear, cutting up a credit card may be helpful for some people — especially those who are struggling with credit card debt. But it’s important to carefully assess whether the rule makes sense for your personal financial plan and goals.

Free Trade: Check out Robinhood's online trading platform and get the first trade on them

An alternative to cutting up credit cards

While a credit card can be a great resource, it’s important to use it responsibly, paying off debt and avoiding the substantial risks that come with tapping into high-interest credit by paying your monthly bill in full, if you can.

Setting a monthly budget that you know you can pay can help. You can go old fashioned with a pen and paper, or use a budgeting app such as YNAB.

Some people also opt for a low-limit credit card, especially if they’re new to credit cards or are trying to build back their credit score without overspending.

Extra Money: Get up to $1,000 in stock when you fund a new active SoFi invest account

Although Orman’s advice on cutting credit cards may not be a fit for you, her other advice on credit cards could be. She recommends paying more than the minimum payment every month, focusing on paying off credit cards with the highest interest rate first and understanding the ins and outs of how credit cards work if you plan to use them.

You don’t have to follow every rule in personal finance. It’s important to understand when to bend and customize them based on your situation.