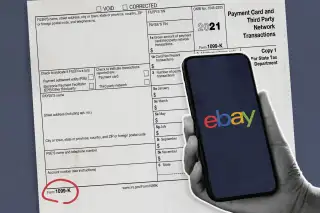

The IRS Is Cracking Down on Small-Time eBay and Etsy Sellers

Starting next year, if you sell a bike or an old camera on eBay, the tax man wants to know.

Beginning in January 2022, anyone who sells more than $600 worth of goods through on the online auction site or rivals like Etsy or Facebook Marketplace will receive a 1099-K form, detailing the transactions for the IRS. For now, only sellers who move $20,000 worth of goods and complete at least 200 transactions have their activity automatically reported.

The new rules, part of the American Rescue Plan Act of 2021, apply to anyone who receives payments for goods or services that are processed by third-party payment networks, like PayPal or Venmo.

The news of the change has stirred up a lot of confusion and worry as it has rippled through online selling communities, with some people threatening to quit selling altogether. “I don’t know why it’s caused so much anxiety,” says tax attorney Barbara Weltman. “There’s nothing to change in terms of your selling activity.”

Rather, the onus for reporting this income will now fall on payment processors, and these companies will need to issue a 1099-K form to anyone who meets that $600 threshold in 2022, Weltman notes. And the reality is that taxpayers were always required to report this income — and pay federal income tax on it — even in absence of a form, she adds. “For people who are doing the right thing, it makes no difference.”

Why the change? One likely reason is to match this category of self-employment income with others, according to Lisa Greene-Lewis, a certified public accountant and the editor of the TurboTax Blog. Beginning in tax year 2020, people who work “micro jobs” or in the gig economy (think: rideshare drivers or delivery workers) received a 1099-NEC form for non-employee compensation in excess of $600. The forthcoming change to the 1099-K form “aligns with some of the other self-employment forms you may receive,” she adds.

Nearly one-in-five Americans earn money selling something online, according to a 2016 survey of adults by the Pew Research Center. There are 19 million global active sellers on eBay, up 5% in the past year, the company disclosed as part of its second-quarter financial results.

For the millions of Americans who make extra cash selling new (and used) items on sites like eBay, the biggest significance of IRS tax code change is likely to be awareness, Greene-Lewis notes. That’s because many sellers may not have sold enough merchandise to receive a 1099-K form previously. “You may have known the old rule and may not be looking out for that form.”

Matching Your Sales Information with the IRS

And the change could actually be helpful: By receiving a form in the mail from payment processors, it will be easier for online sellers who didn’t previously meet that $20,000 and 200 transaction threshold to track their activity — along with knowing exactly what information has been provided to the IRS, Greene-Lewis says.

But the information reported on the 1099-K form is just gross transactions and doesn’t take into account any returns, credits or other types of allowances, Weltman says. And that’s likely to stay the same with the rule change taking effect in 2022. “You really need to be keeping good books and records of your business transactions.”

To ensure you don’t overpay on taxes for any type of self-employment income, Greene-Lewis recommends keeping a thorough record of all your expenses — including things like purchases for your home office or website, supplies, and mileage for driving related to your business. “Whether it’s monthly, every couple of weeks or every quarter, I would definitely recommend that you track your income and expenses instead of waiting until tax time.”

Finally, online sellers can probably expect other changes that will affect their business. Weltman has watched the industry evolve since eBay was founded in the mid-1990s and she and her husband wrote the first edition of The Complete Idiot’s Guide to Starting an eBay Business shortly thereafter.

Be it new platforms, increased competition, fees or changes from Washington, it’s become harder to sell online than it was back in the early days, she adds. “It’s going to be interesting going forward.”

More from Money:

Robinhood for Beginners: A Complete Guide to Investing With the Controversial Stocks App

(An earlier version of this story said the change would take place in 2002, not 2022.)