The Right Way to Turn Your 401(k) Savings Into Retirement Income

If you're counting on your 401(k) plan to help you convert the money you've accumulated during your career into an income that will sustain you in retirement, you may be in for a surprise. A new Government Accountability Office (GAO) report finds that only a third of 401(k) plans have any sort of retirement-income withdrawal option and only a quarter or so offer an annuity. The report makes recommendations to improve this situation, but even if they're adopted, creating reliable retirement income could still be a challenge.

If you're nearing retirement and want to ensure that your 401(k) plus any other savings will be able to sustain you throughout your post-career life, here are four steps that can help you achieve that goal:

1. Estimate how long your nest egg might have to support you. Before you can figure out how much you can reasonably draw from your savings each year, you've first got to know how long you might live. Unfortunately, many retirees mistakenly assume that life expectancy is a good barometer. It's not. Life expectancy is essentially an average, which means many people will live much longer.

Read next: The Right—and Wrong—Investing Risks in Retirement

You can get a more nuanced sense of how long your savings may need to support you by going to the Longevity Illustrator, a new tool designed by the Society of Actuaries and American Academy of Actuaries that estimates your potential lifespan based on factors such as your age, sex and health. By revving up this calculator, you can see, for example, that a 65-year-old man has a 54% chance of living t0 85 and a 16% shot at making it to 95, while a 65-year-old woman has a 64% and 25% chance, respectively, of living to the same ages. You'll also see that the probability that at least one member of a 65-year-old couple (man and woman) will still be alive at 95 is much higher, 37%. The upshot: The more you know about how long you might be around, the better you can plan to ensure that your savings will be there at least as long.

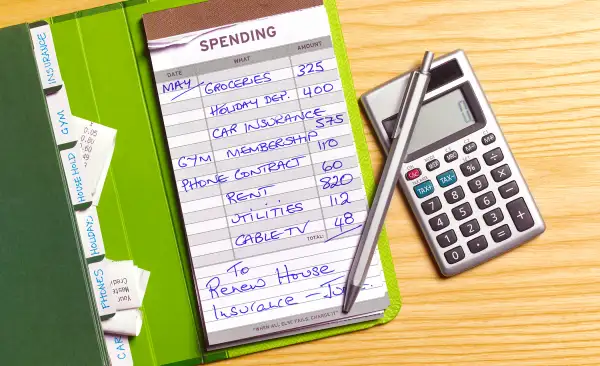

2. Get a handle on your retirement living expenses. Figuring you'll need to replace 80% or so of your pre-retirement income to cover retirement living expenses may be okay in helping you arrive at a savings rate earlier in your career. But once you get to within 10 or so years of retiring, you'll want to have a more accurate fix on what your actual retirement expenses will be.

An online budgeting tool like BlackRock’s Retirement Expense Worksheet can help. The worksheet has room for you to enter more than 50 different expenses ranging from essential items like housing and medical costs to discretionary outlays like travel and charitable donations. You won't be able to predict your expenditures down to the exact dollar, of course. But by making an effort to be as accurate and comprehensive as possible and then updating your budget as you go along, you'll have a much better shot at tracking and managing your retirement spending than by relying on guesswork and rules of thumb.

3. Determine whether you have enough guaranteed income. If the income you'll receive from Social Security and any pensions is sufficient to cover all or most of your non-discretionary retirement expenses, then you may be able to rely solely on draws from your savings to pay the rest of your expenses as well as unanticipated outlays. But if after drawing up a retirement budget you find that Social Security plus any pension income falls short of covering essentials, you may want to consider filling that gap by converting a portion of your savings to guaranteed lifetime income via an annuity.

There are many types of annuities that can provide lifetime income. But if you want one that's relatively easy to understand and that can generate predictable and reliable monthly payments that will last as long as you do, I think an immediate annuity or longevity annuity best fits the bill. With an immediate annuity, you hand over a lump sum to an insurer and immediately begin receiving guaranteed monthly payments for the rest of your life. In the case of a longevity annuity, payments start at later time, say, 10 or 15 years after you retire.

One caveat: Even if you decide you would like to convert some of your 401(k) stash to guaranteed income and your 401(k) is among the minority of plans that actually offer annuities, don't automatically assume your plan's annuities offer the best payout. Although some plans are able to negotiate for better rates, it still makes sense to see if you might be able to get a bigger payment from an insurer outside your plan. To see whether that's the case, you can check out the payouts being offered by a variety of insurers by going to an annuity shopping site like Immediateannuities.com.

4. Create a workable withdrawal plan. Even if you devote a portion of your savings to an annuity, you'll still be relying on the rest of your nest egg (which will likely be invested in a portfolio of stock and bond funds) to pay some expenses. Which means you'll have to come up with a way to draw whatever income you'll need from that portfolio without depleting it too soon.

Assuming you want your nest egg to last a good 30 years or more, that usually means starting with an initial withdrawal of 3% to 4%, and then adjusting that amount for inflation each year to maintain your purchasing power. (The retirement income calculator in the Tools & Calculators section of my Retirement Toolbox can help you devise such a plan.) But there are also other ways to go. For example, a recent Vanguard paper titled From Assets to Income: A Goals-Based Approach to Retirement Spending outlines a "dynamic" spending strategy. It may be able to generate more income initially at least while also reducing the risk of running through your assets too soon by allowing spending to rise a bit (say by 5%) in good markets and decline slightly (maybe 2.5%) in bad ones.

If you're not confident about your ability to manage withdrawals on your own, you can hire an advisory firm to create a withdrawal plan for you. For example, some 401(k) plans offer access to programs by retirement-advice firms Financial Engines and Guided Choice that recommend how to divvy up your savings between stocks and bonds and then tell you how much you can safely spend from your nest egg each month. (Both companies also offer such services outside 401(k) plans.) Similarly, Betterment, Schwab Intelligent Portfolios and Vanguard Personal Advisor Services—all of which use algorithms and other technology to create portfolios—can help individuals create sustainable income from retirement investments.

Bottom line: Whether your 401(k) offers a retirement income option or not, you'll have a much better shot at a secure post-career life if you follow the four steps I've outlined above and take the time to develop a comprehensive plan for converting your savings to income.

Walter Updegrave is the editor of RealDealRetirement.com. If you have a question on retirement or investing that you would like Walter to answer online, send it to him at walter@realdealretirement.com. You can tweet Walter at @RealDealRetire.