There's a Super-Secret Conference Dedicated to Investing Legend Jack Bogle. Here's What It's Like on the Inside

For a few windy days in early October, I was one of 200 people who dropped off the map. I told my friends and family I was going to “Philadelphia” — the terms of my registration prohibited me from telling them where, exactly — and disabled my phone’s location services. It was here, at an ultra-exclusive three-day meeting organized by a Marine veteran, where we discussed an issue of obsessive importance to all assembled: low-cost index mutual funds.

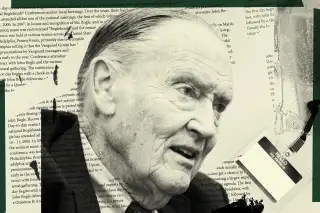

These conference-goers weren't the high-rolling stock market fanatics you see in movies, staking their fortunes on one big bet and agonizing over short-term market misfortune. Instead, these were mom and pop investors — driver’s ed instructors, doctors and web developers by day — who embrace long-term commitments to broad, boring investments. Known as the Bogleheads, these investors follow the teachings of John Bogle, who founded the pioneering investment firm Vanguard in 1975. I had joined them to learn about passive index fund investing, a strategy far removed from the glitz and glamor of picking individual stocks — but one that research says works.

Bogle is widely regarded as the father of index investing, a strategy that functions best when investors sit on their hands for decades. The investments the Bogleheads choose, low-cost index mutual funds and exchange-traded funds (ETFs), are designed to mimic stock or bond markets, not beat them. Bogleheads' core belief— stay the course — is so essential to their investment strategy that mentioning it while booking your hotel room for the Boglehead Conference unlocked a discounted nightly rate.

For this group of zealous investors, the promise of spending three days with kindred spirits was well worth the $325 cost and the scramble to snag one of just 200 spots that sold out in less than a day. While talk about Schwab and Vanguard’s most compelling offerings might make friends and family tune out, the Bogleheads had a captive and eager audience in each other.

“The best part is that no one rolls their eyes,” says Paul James, a former PR professional who traveled from his home in Orlando to attend the conference. There’s a reason this meeting of investors sells out every year: the annual conference is a chance to match faces to message board usernames and discuss (or commiserate about) the market in person. The Bogleheads Conferences have been operating for nearly two decades, having grown out of an online community once called the “Vanguard Diehards.” Now based on the Bogleheads.org forums, the community is a place where investors can ask questions and share advice about everything from 401(k)s to health insurance.

Some of the event’s exclusivity and security can be explained by the group’s former frequent guest of honor: Jack Bogle himself. The champion of the average investor attended almost every annual Bogleheads meet-up, says Mel Lindauer, president of the John C. Bogle Foundation for Financial Literacy and the event’s organizer. A Marine veteran, Lindauer knows a thing or two about security — hence the vague directions and GPS precaution.

In 2019, the security measures were still in place, even if, as Lindauer puts it, “this is the first year we know, in advance,” that Bogle won’t attend. He died in January, and in place of his traditional Thursday morning "fireside chat," this year’s panels kicked off with a celebration of the Vanguard founder’s life as shared by two of his daughters and a group of former assistants.

While Bogle’s absence marked a notable shift from previous conferences, it didn’t stop attendees from traveling to Philadelphia from as far away as Germany to attend panels that touched upon everything from behavioral finance to ESG indexes, or so-called "Environmental, Social, and Governance" investments focused on social responsibility or sustainability — neither of which I had ever given much thought to, personally.

At a conference of expert investors, I was a complete beginner — which, as it turns out, wasn’t as much of a problem as I’d anticipated. While the folks who attend the conference year after year have an enviable grasp of investment knowledge, they didn’t look down on me for asking how to get started. In fact, they were happy to share some tips to get me on the right track. Here are the Bogleheads' key tips for beginners:

Early investing is better than perfect investing

Sure, you want to make the best moves you can with your money. But don’t get overwhelmed with your options and let decision paralysis keep you from saving now. While it’s important to have a well-researched plan for the long haul, you should at least be contributing to your 401(k). Why? The magic of compound interest, that property that Albert Einstein called the eighth wonder of the world, where your money grows that much faster because you keep earning interest on your interest. To illustrate their strategy, attendees often stressed that a person who starts investing small amounts in their early 20s will be better off than someone who starts later and invests larger amounts later to catch up.

Don’t try to time the market

If you thought investing was about picking individual stocks, well, you’re not necessarily wrong. That's one approach, and there’s a certain drama to taking a big gamble on a small stock or watching the market fluctuate throughout the day. But for the Bogleheads, the best way to play is through passively-managed index funds like those pioneered by Vanguard. That way, while your investment will rise and fall with the market, you’re not a victim to any particular company’s misfortune.

Investing in passively-managed funds is a core Boglehead tenet — and research shows the strategy is a sound one. The majority of actively-managed funds have underperformed the stock market for nearly a decade, CNBC reports, citing the annual S&P Dow Jones Indices report. In other words, trying to pick winners doesn't work; simply riding out the market's ups and downs does.

Don’t peek

Yes, you can check in on your investments throughout the day to see how they’re doing — but does that do you any good? If you ask the Bogleheads, the answer is no.

At the 2019 Bogleheads Conference, a common question among attendees was “do you peek?” That is, do you check in on your investments, even though you intend to leave them alone for years to come?

While various Bogleheads do cop to peeking — every so often, a few times a year —they know they shouldn’t react to market fluctuations. The key is, as one attendee mentioned to me, to “set it and forget it”— that is, once you know what you’re investing in, leave it alone, let the market do its thing and try not to worry.

As someone who already feels like I have a lot to worry about, this was music to my ears. When I got home from the conference, I did peek, just once, to make sure my 401(k) contribution was sufficient and invested in a broad index fund. Satisfied with what I saw, I logged out — and haven't been back since.