This New Tweak to the GOP Health Care Bill Will Make Medicare Less Stable

House Republicans have tweaked their Obamacare replacement plan in an effort to help the bill win passage this week, including a proposal that would further weaken Medicare’s long-term finances by accelerating a tax break for the rich.

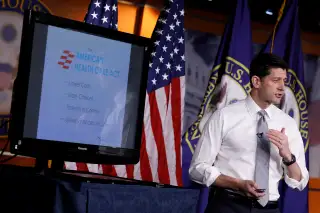

On Monday night, House Republicans revealed changes to the American Health Care Act, the legislation championed by House Speaker Paul Ryan to replace Obamacare. The full House is expected to vote on the bill Thursday, and the tweaks were designed to help win over lawmakers on the fence.

A key change would repeal a Medicare tax on high earners a year earlier than originally proposed. Obamacare, also known as the Affordable Care Act, imposed an additional payroll tax of 0.9% on individuals earning more than $200,000 and couples earning more than $250,000 (among other changes to Medicare). Revenue from this tax helped shore up the trust fund for Medicare Part A, which pays beneficiaries’ hospital costs and is funded through a dedicated payroll tax.

Monday’s changes would repeal this tax this year instead of in 2018 as originally proposed in the American Health Care Act, leading to about $10 billion of lost revenue, according to Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget. The change would appear to be retroactive to Jan. 1, 2017, although the manager's amendment, as the changes are known, does not give an exact effective date.

“Here you have a bill where Congress is voting to actively undermine the trust fund, and it’s singularly for the purpose of providing tax breaks for the wealthy,” says Stacy Sanders, federal policy director for the Medicare Rights Center.

Repealing the high earners’ payroll tax one year sooner would not likely shave a full year off the projected depletion of the hospital trust fund in 2025, says Juliette Cubanski, associate director of the Program on Medicare Policy at the Kaiser Family Foundation. Still, the move would weaken Medicare’s finances just as more baby boomers are aging into the program.

Once the trust fund runs dry, incoming payroll-tax revenues will be able to cover only 87% of the program’s costs, according to projections by the Medicare trustees. If nothing is done, benefits will likely be cut.

“The number of beneficiaries, continues to grow,” Cubanski says. “The trust fund obviously needs to be shored up one way or another.”